When Beeple's NFT shattered records with an astonishing sale in 2021, everyone assumed it was a one-off phenomenon — a digital rarity in the vast sea of the internet. Little did they know that this was just the beginning of a digital revolution.

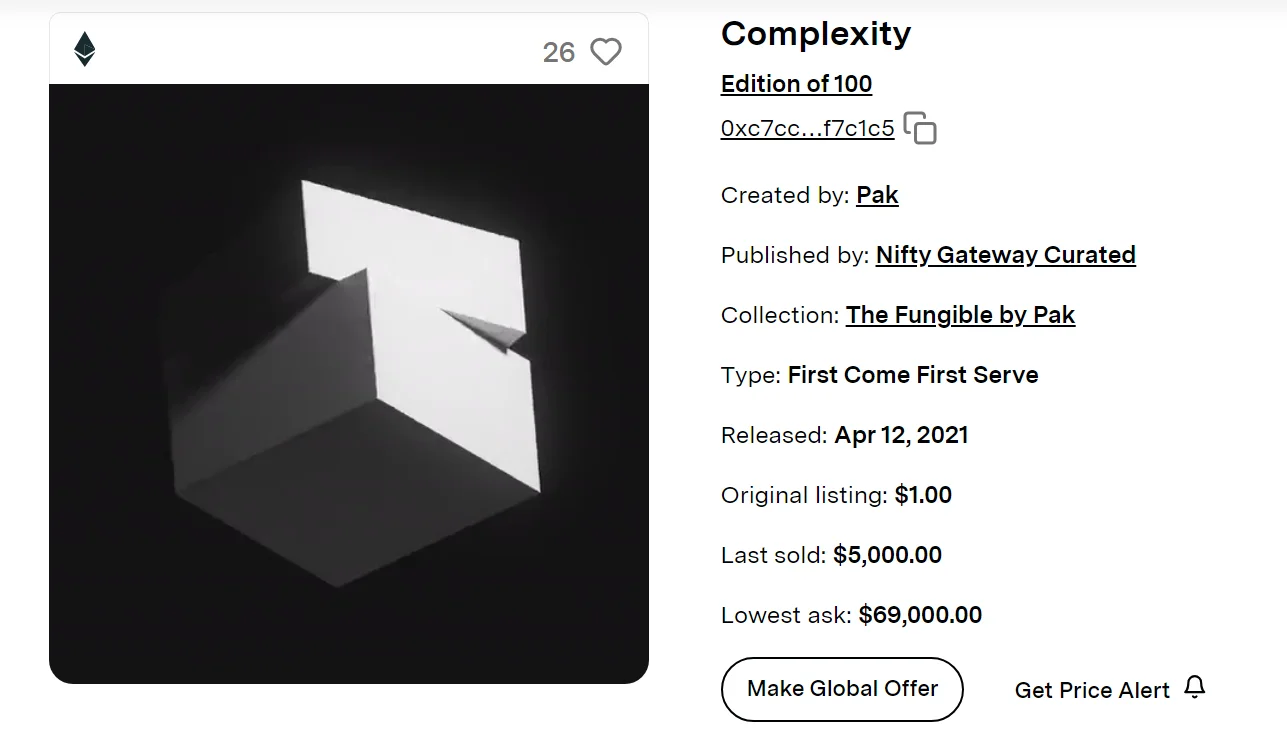

Beeple's artwork, "The First 5000 Days," sold for a staggering $69.3 million, breaking all previous records for the most expensive digital artwork ever sold. This left many astounded by the sheer value attached to a digital creation.

But soon after, "The Merge" made headlines, selling for another impressive sum of $91.8 million. It became clear that Non-Fungible Tokens (NFTs) were not just a fad, but rather, they were here to stay and transform the way we perceive and trade digital assets.

In this blog, Global Blockchain Solution will explore with you the fascinating world of NFTs, answering questions like "What is an NFT?" and "How can you make NFTs?" as we delve into the realms of NFT art, digital ownership, and the immense potential this technology holds for artists, collectors, and investors.

So, if you're ready to embark on a journey into the future of digital ownership, let's dive into the world of Non-Fungible Tokens.

This Article Contains:

What are NFTs?

NFT stands for "non-fungible token." But what does this mean?

To begin with, we have to understand what is fungibility and non-fungibility. According to Cambridge Dictionary, “fungible” means “easy to exchange or trade for something else of the same type and value”. A typical $100 bill, for instance, is fungible. It doesn’t matter which one you have – its value always remains $100.

Conversely, non-fungible means something that cannot be exchanged for something else of the same type. For instance, John Lennon's Gibson J-160E guitar – used to compose rock band Beatles’ biggest early hits including “All My Loving”, “I Want to Hold Your Hand”, and “She Loves You” – isn’t fungible.

The guitar’s significance lies in the fact that John Lennon used it and, that too, before the band attained its global cult following. So, it cannot be exchanged for any other Gibson J-160E guitar. Hence, it’s non-fungible.

Similarly, Non-Fungible Tokens are unique digital assets that represent ownership of something in the digital realm. Each NFT is one-of-a-kind and, like John Lennon’s guitar, cannot be interchanged like money or cryptocurrencies (which are "fungible").

Some examples of assets NFTs can represent include:

Digital artwork: The artist can sell an NFT of their artwork, which acts like an original certificate of authenticity and ownership. So, even if copies exist online, the NFT buyer owns the "official" original.

Collectibles: Like unique baseball cards, NFTs can represent collectible items that have provable scarcity and value.

In-game assets: Game developers can sell in-game items like character skins and power-ups as NFTs. Players truly own their in-game NFT assets. Assets like Nike’s .SWOOSH collectibles can be used in EA Games in the future following their partnership earlier this year.

Domain names: NFT domains like ".nft" are sold by developers and offer ownership of a unique web address.

So, in summary, NFTs digitally represent ownership of something unique. They are minted (created) and recorded on blockchains like Ethereum, which provides a tamper-proof public ledger of NFT ownership that anyone can verify.

Owning an NFT is like owning the "master record" of a digital asset, giving you control, scarcity, and the ability to sell it directly to another owner. NFTs open up new opportunities for creators, collectors, gamers, and entrepreneurs alike.

The Technical Foundations of NFTs

NFTs represent a paradigm shift in how we conceive of digital ownership and assets. But how do they work?

This has been made possible by the coming together of several key technological innovations. Let’s do a deep dive into the technical machinery powering NFTs.

1. Blockchains: Distributed Ledgers Underpinning Digital Provenance

Blockchain technology serves as the foundation for recording and tracking NFT ownership. The Ethereum blockchain is the dominant platform for NFTs currently. Its decentralized architecture consists of over 7,000 nodes distributed globally that maintain a synchronized ledger of transactions.

Also Read: Blockchain 101: How to create your own crypto app?

Ethereum utilizes proof-of-stake mining where specialized computers called miners solve cryptographic puzzles to validate transactions and mint new blocks. The computational work required for mining bolsters the security and immutability of the blockchain.

On Ethereum, all transactions such as NFT mints, sales, and transfers are crystallized into the blockchain creating a permanent record of provenance. For instance, the on-chain record unambiguously proved the $69.3 million Beeple NFT purchase by MetaKovan.

2. Smart Contracts: Programmable Ownership and Royalties

Smart contracts are self-executing scripts coded into the blockchain that enable programmable ownership for NFTs. They allow creators to bake in customized royalty schemes, transfer rules, minting limits, and other advanced logic.

The ERC-721 standard pioneered NFT smart contracts in 2018 and remains the dominant standard. However, ERC-1155 advanced multi-token contracts are gaining steam and being utilized by projects like Axie Infinity as an in-game commodity. Hybrid smart contracts that leverage off-chain computing like InterPlanetary File System (IPFS) while maintaining core on-chain logic are also emerging.

NFT royalties written into smart contracts guarantee creators receive proceeds from secondary sales. For instance, the $6 million sale of Beeple's "Ocean Front" enforced its 10% royalty payout to the artist via its baked-in smart contract.

3. Cryptography: Mathematical Guarantees of Security and Ownership

At its core, cryptography provides the advanced mathematical infrastructure that secures and verifies all NFT and blockchain transactions. Cryptographic hash functions like SHA-256 and Keccak-256 enable blockchain mining and air-tight immutable ledgers.

Asymmetric encryption via public/private keys ensures only the true owner of an NFT can transfer ownership. Digital signatures based on Elliptic Curve Cryptography definitively prove ownership behind transactions.

These battle-tested cryptographic primitives inherited from Bitcoin form the basis for trustless P2P exchange of NFTs between counterparties without any intermediaries.

4. NFT Standards: Interoperability Between Platforms

Standardization is crucial for any new technology segment, enabling interoperability and widespread adoption. Standards like ERC-721 allow NFTs and wallets built by different developers to seamlessly interact across platforms.

Such community-driven standards are extensible and designed to evolve. For instance, ERC-4626 proposed adding better fund management options for NFTs compared to the basic “transfer and approve” model of ERC-721.

The technological foundations covered here enable the unique characteristics of NFTs. However, technical evolution through new standards and proposals will shape the future development of NFTs.

Core Characteristics and Attributes of NFTs

NFTs derive their value from certain unique attributes made possible by the underlying blockchain technology stack. These characteristics differentiate NFTs from other digital assets and are crucial for understanding their disruptive potential.

1. Verifiable Scarcity and Ownership

Blockchain's tamper-proof ledger enables true digital scarcity for the first time. Creators can impose hard caps on NFT supplies, verifiably encoded on-chain. Bored Ape Yacht Club famously capped its collection at 10,000 NFTs, driving scarcity.

Also Read: Impending Doom or Is Web3 the Future of the Internet?

Ownership histories are immutably tracked on-chain. Whenever an NFT changes hands, the transaction is recorded on the blockchain. This transparent ledger verifies ownership and provenance.

2. Indivisibility and Uniqueness

NFTs are designed to be indivisible assets, implied by their "non-fungible" nature. This means a single Bored Ape Yacht Club NFT cannot be divided among multiple owners.

You might think that how is The Merge by Pak indivisible if its 312,686 units were bought by 28,983 collectors? Well, as the auction process proceeded, individual collectors could purchase The Merge NFTs. These NFTs were then merged as the auction ended.

So, technically, The Merge is a collection of 312,686 NFTs and not a “single NFT” divided into 312,686 units.

3. Interoperable and Programmable

The adoption of standards like ERC-721 allows NFTs to seamlessly port across different applications and platforms, including marketplaces, games, and metaverse worlds.

Their programmability via smart contracts enables creators to endow them with customized attributes and logic, like dynamic traits, royalty schemes, unlockable content, and much more.

4. Extensible and Composable

NFTs can represent both static and dynamic objects. For instance, Axie Infinity enables people to collect, breed, and battle fantasy creatures called "Axies," whose attributes and abilities can change over time.

NFTs can also be composable. For instance, with RTFKT, you can dress up your digital persona with NFT outfits and accessories.

5. Permissionless Innovation and Exchange

Anyone can create NFTs without gatekeepers on permissionless blockchains like Ethereum. This has unlocked permissionless innovation, as exemplified by the breadth of NFT projects.

P2P NFT exchange powered by cryptocurrency and smart contracts enables direct value transfer between creators and collectors without intermediaries.

The unique attributes covered above promise to profoundly expand how we conceive of digital ownership, assets, and commerce in the emerging metaverse. However, as NFTs evolve, new capabilities will emerge via continued technical innovation in this space.

How to Create NFTs

With the basic foundations covered, let's now dive into the step-by-step process for how to mint your NFT.

1. Setting Up Cryptocurrency Wallets

To create NFTs, you first need to set up digital currency wallets capable of holding Ethereum or other cryptocurrencies. MetaMask and Coinbase Wallet are two popular options here. These wallets enable you to securely pay gas fees and transaction costs associated with NFT minting and trading.

2. Picking an NFT Marketplace

Next, you need to choose an NFT marketplace for minting and listing your NFTs. Popular marketplaces include OpenSea, Rarible, Foundation, SuperRare, and more. Each has its own creator onboarding process and requirements to review.

3. Creating & Uploading Your NFT

Once your wallet and marketplace accounts are ready, it's time to create the actual NFT asset like an image, 3D model, music track, or something else. Be sure to give it a compelling name and description to generate interest.

4. Setting Royalties, Properties, and Other Details

Most NFT marketplaces let you configure royalties (typically 10% or less of secondary sales) to earn ongoing income. You can also set NFT categories, toggle visibility, and add unlockable content or other metadata.

Also Read: What is Real-World Asset Tokenization? How it works and challenges?

5. Minting on the Blockchain

The actual NFT minting involves initiating a blockchain transaction that immortalizes an NFT record containing your artwork and metadata. At this point, you'll need to pay the "gas" fees for the minting.

6. Listing Your NFT on Marketplaces

Finally, you need to officially list your NFT on selected marketplaces, which enables buyers to view and purchase your NFTs. Congratulations, you're now an official NFT creator!

There are many creative directions for aspiring NFT artists and collectors to explore from 3D NFTs to fractionalized NFTs, music NFTs, and more. With a basic grasp of the minting process, you can now turn your unique ideas into blockchain-based NFTs.

To Wrap It Up

NFTs represent an exciting new model of digital ownership, underpinned by groundbreaking technologies like blockchains, smart contracts, and cryptography. As we have explored, these technical foundations enable the unique attributes of NFTs such as digital scarcity, verifiable provenance, and programmable ownership.

By demystifying the inner workings of NFTs, individuals and businesses can better leverage them for creative projects, community engagement, and unlocking new revenue streams. However, NFTs are still in their infancy. Continued innovation around standards, interfaces, and applications will shape their long-term impact across industries.

Understanding the current technology empowers us to envision the future possibilities of NFTs and the ownership transformation they herald. If you have any queries or want to develop your own NFT, feel free to contact us and schedule a free 15-minute consultation call with our experts.

Frequently Asked Questions

1. What exactly does an NFT do?

NFTs represent unique digital assets like art, collectibles, in-game items, etc. on the blockchain. Each NFT acts as proof of ownership and authenticity for the underlying asset. The blockchain provides a tamper-proof ledger to record ownership and transaction history for NFTs.

2. How does an NFT make money?

There are a few ways NFTs can make money:

The initial sale or when the NFT creator mints and sells the NFT to a buyer.

Royalties encoded in the NFT's smart contract from secondary market sales. The creator gets a percentage (typically 5-10%) whenever the NFT is resold.

Price appreciation if the NFT increases in value on the secondary market and the owner sells it for profit.

Utilizing the NFT for commercialization, like merchandise, derivatives, etc.

3. Why do people buy an NFT?

Some reasons people buy NFTs include:

To collect rare, unique digital art and collectibles.

As investments hoping to profit from rising NFT market value.

To support artists and get royalties from secondary sales.

For the status value of owning culturally significant NFTs.

To use NFTs in games, virtual worlds, and other applications.

4. What is an NFT for beginners?

NFT stands for a non-fungible token. It represents a unique digital asset like artwork, music, collectibles, etc. recorded on the blockchain. NFT ownership is verifiable thanks to the blockchain ledger. And tokens are "non-fungible" meaning they cannot be exchanged like money - each NFT is distinct. NFTs enable digital scarcity, proof of ownership, and royalties for creators.

Comments

Share Your Feedback

Your email address will not be published. Required fields are marked *