For decades, the global financial system has been like a dusty old bank vault - controlled by governments, banks, and credit card companies who hold the keys.

Your hard-earned money has to pass through a complex web of opaque middlemen, each taking a slice of your wealth through fees, interest rates, and delayed processing times.

Even digital payment services like PayPal can take up to 5 business days to process a simple wire transfer - an eternity in today's digital age.

Then a mysterious figure named Satoshi Nakamoto created Bitcoin and flung open the vault doors. His 2008 whitepaper was the blueprint for a dazzling new financial universe - digital cash without centralized control. Transactions could zip peer-to-peer across a decentralized network at the speed of the internet, verified by unbreakable cryptographic code rather than fallible humans.

Over a decade and a half later, cryptocurrencies have exploded from obscure digital experiments into one of the hottest, most potentially transformative trends in finance. The total market value is above $1.4 trillion in 2023, a meteoritic rise fueled by coins like Ethereum and USDT. Venture capitalists poured rivers of cash into crypto and blockchain startups, seduced by visions of financial revolution.

Yet for many mainstream investors and businesses, cryptocurrencies remain shrouded in mystery. How exactly are these magical internet coins conjured into existence? Can they reshape finance forever or will the whole market blow away in the next storm?

Today with Global Blockchain Solution, let's crack open the vault and unravel the inner workings of this parallel financial universe.

This Article Contains:

What Are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that are secured by cryptography and designed to work as mediums of exchange. Unlike centralized fiat money issued by governments, cryptocurrencies operate independently across a decentralized network.

Bitcoin, the first and most popular cryptocurrency (by market capitalization), was created in 2009. It uses a distributed ledger called blockchain to record transactions and issue new Bitcoins to users who contribute computing power to verify transactions. This novel method of issuing currency and securing payments without centralized control paved the way for other cryptocurrencies.

Today, thousands of cryptocurrencies enable fast, borderless, peer-to-peer transactions between individuals across the globe. Leading coins like Ethereum allow decentralized applications to be built on top of their networks. In 2021, the total market value of all cryptocurrencies peaked at approx. $3 trillion, indicating the potential of this rising giant.

The Promise of Decentralized Finance

While still an emerging technology, cryptocurrencies offer an alternative to traditional finance by eliminating intermediaries and giving users control over their money. But can this decentralized parallel financial system deliver on its promise to reshape finance as we know it?

Advocates argue that the transparency and accessibility of cryptocurrencies can revolutionize finance in the digital age. Transactions occur almost instantly without the need for banks or other third parties, lowering fees and processing times. The decentralized nature also makes censorship and manipulation difficult, unlike centralized systems.

Moreover, cryptocurrencies expand financial access. Anyone with an internet connection can receive, hold, and transfer cryptocurrency peer-to-peer. This enables the 1.7 billion unbanked adults globally to participate in the financial system without paying exorbitant fees and annual charges.

However, regulatory uncertainty and price volatility have so far limited the mainstream adoption of cryptocurrencies as payment methods. And the crypto space is still frequently associated with illegal activities like money laundering and the dark web.

Additionally, decentralized systems introduce new risks like irreversible transactions and lack of recourse in case of fraud or theft. Critics argue the anonymity emphasized by some cryptocurrencies can enable criminal behavior.

The road ahead remains challenging. But if its most ambitious promises are achieved, the technology underlying cryptocurrencies could profoundly reshape finance and the economy.

Businesses are already exploring uses like blockchain supply chain tracking and smart contracts. As more regulated applications emerge, there is potential for decentralized finance to complement rather than displace traditional systems.

Understanding the Basics

Let's build a solid foundation of cryptocurrency by understanding the basic concepts underlying this new technology.

⮊ Blockchain Technology

The innovation that enabled cryptocurrencies is blockchain technology. But what exactly is a blockchain and how does it work?

⮊ What is Blockchain?

A blockchain is essentially a decentralized digital ledger of transactions, not controlled by any single entity. The name comes from its structure of connecting blocks of data, secured using cryptography.

Unlike a centralized database like those operated by banks, blockchain allows an open, transparent record of transactions accessible to all participants in the network. The record cannot be easily altered retroactively, providing trust through transparency.

Also Read: Blockchain Technology Explained: What is Blockchain?

This breakthrough addressed a key vulnerability in digital transactions - the need for a trusted third-party intermediary like a bank to validate and settle transactions. The decentralized structure means no single point of failure. Even if one node goes down, all others keep a copy of the ledger.

⮊ Role of Blockchain in Cryptocurrencies

Permissionless blockchains like Bitcoin allow digital assets to be decentralized and securely transferred between parties without intermediaries. They provide complete transparency, as anyone can inspect the ledger of transactions.

For example, while you trust your bank to hold your money, Bitcoin users trust the mathematics underlying the blockchain. Instead of a bank verifying the transfer of value between accounts, network nodes use cryptography to verify transactions and add new blocks. This eliminates the need for a middleman.

By solving the issue of decentralizing trust, blockchain enabled the development of cryptocurrencies - a transformative leap in the evolution of digital money.

Also Read: Exploring the Evolution of Blockchain: A Journey from 1982 to Present

What Are Different Cryptocurrencies?

While Bitcoin was the first cryptocurrency, many others have been developed over the past decade. Here are some major ones:

1. Ethereum

Created in 2015 by Vitalik Buterin, Ethereum built on Bitcoin's innovation but extended its capabilities by introducing smart contracts. These self-executing scripts run on the Ethereum blockchain, enabling decentralized applications like DeFi, NFTs, games, etc.

The native currency is Ether (ETH). Ethereum dominates decentralized apps and finance, though high gas fees and congestion limit scalability.

2. Solana

This highly scalable blockchain uses a unique proof-of-history consensus mechanism that processes transactions in seconds at a fraction of the cost of Ethereum. Solana has seen massive growth thanks to fast speeds, low fees, and developer tools.

Also Read: What is Consensus Mechanism in Blockchain?

The native SOL token ranks among the top 10 cryptocurrencies. However, technical glitches have raised questions about its stability.

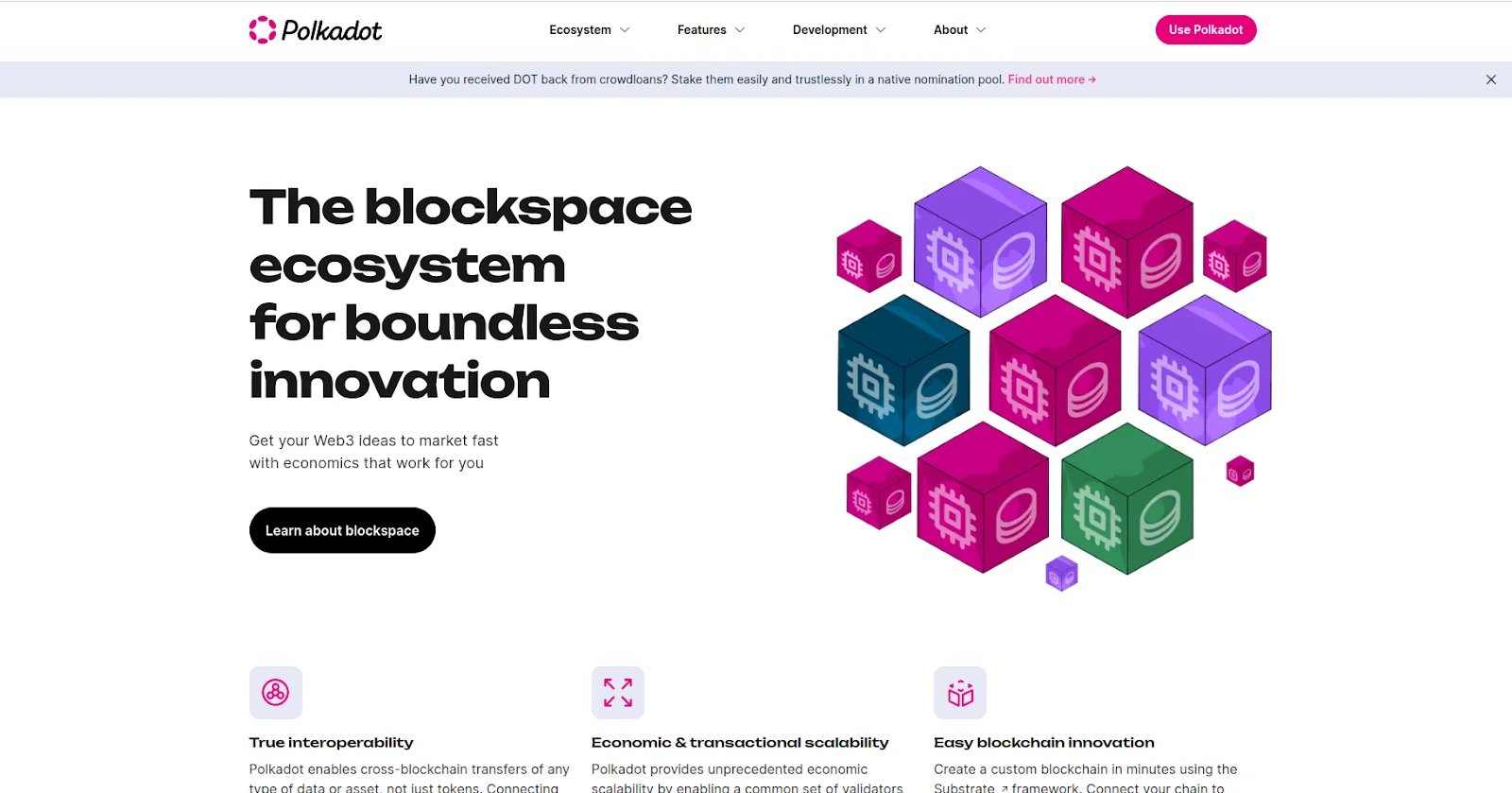

3. Polkadot

Founded by Ethereum co-founder Gavin Wood, Polkadot aims to solve interoperability and scalability. Its "relay chain" framework allows different blockchains to share security and communicate.

Developers can build customized "parachains" that plug into the central network. DOT is the native token used for governance, operations, and creating parachains.

4. Cardano

Developed by Ethereum co-founder Charles Hoskinson, Cardano uses a proof-of-stake consensus that enables it to operate with greater energy efficiency than Bitcoin.

It aims to allow smart contracts while prioritizing peer-reviewed research and regulatory compliance. The ADA token facilitates transactions on the network.

5. Hedera

Created by veterans from major tech companies, Hedera aims to be a decentralized enterprise-grade public network. It uses a unique hashgraph algorithm rather than blockchain for faster and more secure transactions.

The network is governed by a council of global entities running nodes. HBAR is the native utility token used for payments and fueling dapps.

6. Ripple

Ripple operates the XRP digital currency and payments network RippleNet. It is designed for cross-border payments and currency trades between major financial institutions.

Rather than mining, XRP was pre-mined and distributed to investors. It uses a Byzantine Fault Tolerance consensus to validate transactions. The company aims to complement rather than compete with banks.

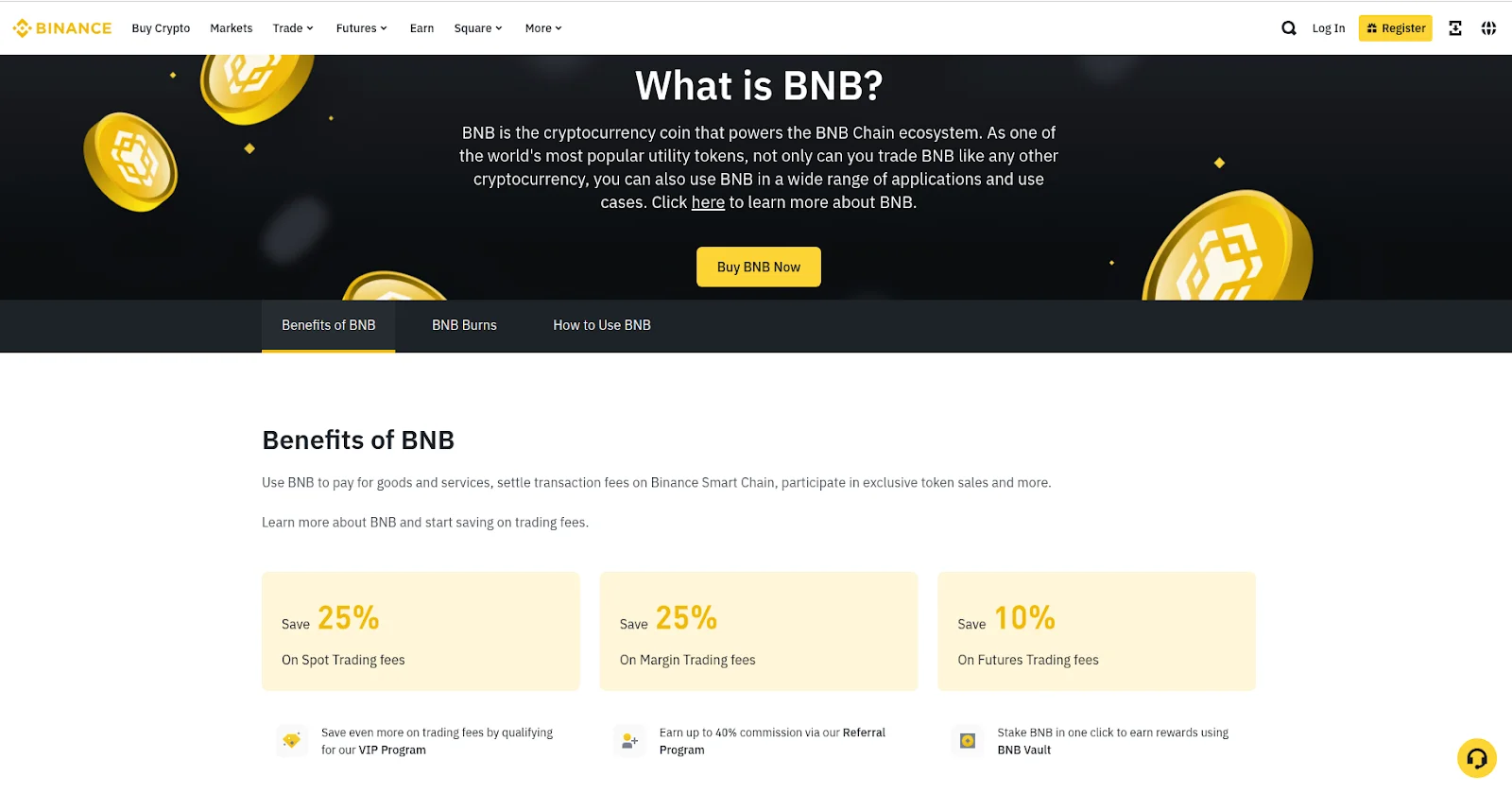

7. Binance Coin

Issued by leading crypto exchange Binance, BNB serves multiple purposes in the Binance ecosystem. It can be used for trading fees, paying for travel and entertainment, and more.

Binance Chain uses a proof-of-stake consensus, allowing staking rewards for BNB holders. The token has risen to become a top 10 cryptocurrency by market cap.

Common Characteristics of Cryptocurrencies

Despite the diversity, cryptocurrencies share these key common traits:

1. Decentralized

Cryptocurrencies operate on public blockchains spread across nodes rather than controlled by a single entity. For example, while banks maintain centralized control of financial transactions, Bitcoin operates on thousands of nodes across a peer-to-peer network. This avoids central points of failure.

2. Transparent

Most blockchains are open for anyone to inspect. An interested citizen in Japan can monitor Ethereum blockchain transactions using platforms like EtherScan just as easily as a developer in Argentina. This radical transparency enables public verification of transactions.

3. Secure

Cryptography secures transactions and controls the creation of new currency units. Bitcoin uses hash functions and digital signatures to encrypt transactions, preventing counterfeiting. Bitcoin’s ingenuity lies in its prevention of double-spending, a known issue preventing the use of digital assets.

4. Fast and Global

Cryptocurrency transactions are broadcast instantly across the blockchain network and settled quickly, enabling seamless global transactions. For example, XRP transactions take 3-5 seconds to complete versus traditional wire transfers that can take days and incur high fees.

5. Irreversible

There is no central party that can authorize chargebacks or cancellations once a cryptocurrency transaction occurs and is verified on the blockchain. While this provides permanence, it deprives consumers of any recourse in case of erroneous or fraudulent transactions.

Advantages of Cryptocurrencies

By design, cryptocurrencies equip their proponents with several advantages. They include:

1. Financial inclusion

By enabling direct peer-to-peer transactions, cryptocurrencies can provide financial services to underbanked populations and those living in countries with unstable economies. For example, Dash has gained traction in Venezuela due to fast speeds and negligible network fees.

2. Empowered users

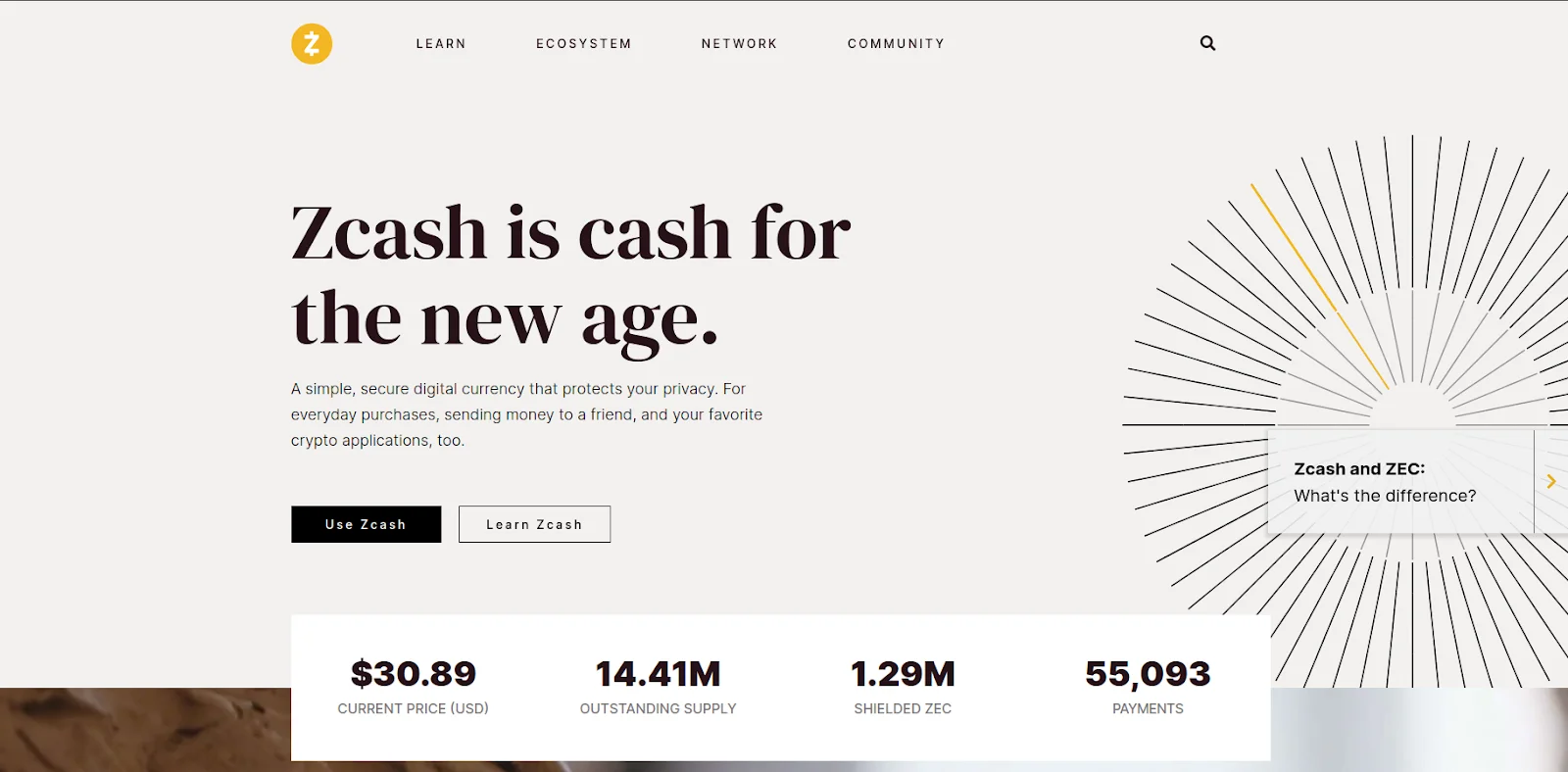

Cryptocurrency users have sovereignty over their funds and transactions without oversight from governments or financial institutions. This avoids centralized points of failure or censorship. Platforms like Zcash provide enhanced privacy and anonymity through cryptographic tools like zero-knowledge proofs.

3. Enhanced security

Leading cryptocurrencies use strong encryption and blockchain-based verification to make transactions highly secure and resistant to fraud. And decentralized networks have no central point of attack.

4. Lower fees

Sending funds peer-to-peer avoids the high transaction fees charged by banks and remittance services for wire transfers. Networks like Nano and Stellar offer direct transactions with minimal network costs.

5. Accessibility

Users in remote areas can access cryptocurrency systems as long as they have an internet connection, expanding financial inclusion.

6. Programmability

Smart contract cryptocurrencies like Ethereum enable complex decentralized applications like DeFi, NFT marketplaces, decentralized governance, and more. These expand the utility of blockchain technology.

Challenges of Cryptocurrencies

1. Volatility

Cryptocurrencies are subject to greater volatility than fiat currencies without central bank stabilization. The prices fluctuate wildly based on news, regulations, supply/demand shifts, and other factors.

2. Scalability

Most early blockchains like Bitcoin and Ethereum are limited in transactions per second, leading to network congestion and high fees during peak periods. This year, a user paid as much as 64 ETH (approx. $115,000) for a single transaction on 8th May 2023. However, newer blockchains like Solana are overcoming this challenge.

3. User experience

Managing private keys, using wallets securely, understanding complex metrics like gas fees, and navigating decentralized apps have a steep learning curve for mainstream users. UX improvements in wallets and interfaces are addressing this.

4. Illegal uses

While the degree of anonymity has facilitated illegal activities, blockchain analysis makes transactions increasingly traceable. Law enforcement has been successful at tracing criminality on public blockchains.

5. Security risks

Individual users face risks like compromised private keys or losing access to wallets. However, hardware wallets and institutional custody solutions provide professional-grade security.

6. Lack of recourse

Once executed, crypto transactions are generally irreversible. This lack of consumer protections remains a hurdle to mainstream adoption. While challenges remain, cryptocurrencies offer revolutionary advantages in financial access, resilience, and innovation. Ongoing technological developments aim to make this technology more scalable, usable, compliant, and integrated with mainstream finance.

The Future of Cryptocurrency

While still in its early stages, cryptocurrency is poised to play a transformative role in finance and beyond. Here we explore the future evolution of cryptocurrencies.

1. Mainstream Adoption

For cryptocurrencies to play a bigger role, mainstream adoption is key. Currently, only an estimated 13.7% of Americans own cryptocurrency. Greater investment from institutional players like banks, easier integration into everyday payments, and simpler user experiences will drive mainstream acceptance.

As familiarity and stakeholder buy-in grow, more governments may assign legal tender status to cryptocurrencies as El Salvador did to Bitcoin alongside the US dollar. This endorses cryptocurrency as an official payment method in the country rather than just an asset class.

2. Evolving Technology

The technology behind cryptocurrencies will continue advancing to build better platforms. Blockchains are getting faster, more scalable, and more interoperable. Decentralization is becoming more sophisticated through governance mechanisms and layered architectures.

Many experts see the biggest wave of innovation still ahead. Future cryptocurrencies may incorporate groundbreaking capabilities around transaction privacy, built-in governance, identity frameworks, decentralized storage/computing, and more.

3. Integration not Replacement

Rather than replacing fiat currency and traditional finance, cryptocurrencies will likely serve as a complement. Stablecoins form an intriguing bridge, connecting the efficiency of crypto payments with the stability of fiat currency. And central bank digital currencies may integrate select cryptocurrency design principles.

Distributed ledgers are also transforming financial infrastructure behind the scenes via security settlement layers between banks, offering benefits without consumer disruption.

4. New Decentralized Economies

Beyond payments, cryptocurrencies enable emerging decentralized economies and business models powered by blockchains and smart contracts. These range from decentralized finance and insurance to non-fungible tokens reshaping digital ownership. Such applications will expand the utility of cryptocurrencies.

Cryptocurrency has sparked a revolution in economics and technology. And while the future trajectory has plenty of uncertainty, the overall outlook points to this innovation continuing to build momentum and impact.

Final Thoughts on Cryptocurrency

More than one and a half decades since Bitcoin's launch, the experiment with decentralized money and finance is just getting started. By disintermediating control points and gatekeepers, cryptocurrency and its underlying technology give power to the edges - to users and community contributors.

The coming decades will reveal to what extent that power shifts the overall dynamics of money, economics, and opportunity. Ride on this bandwagon before your competitor. Get in touch to learn more about cryptocurrencies and book a free 15-minute consultation with Global Blockchain Solution experts to resolve queries about your implementation.

Frequently Asked Questions

1. What is crypto in simple terms?

Cryptocurrency, short for "crypto" or "digital currency," is a form of decentralized and digital currency that uses cryptography for security.

Unlike traditional currencies issued by governments (fiat currency), cryptocurrencies operate on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

The most well-known cryptocurrency is Bitcoin, but there are thousands of others, each with its unique features and uses.

2. Is cryptocurrency real money?

Cryptocurrency is often considered a form of digital or virtual money, but its acceptance as "real money" varies.

While cryptocurrencies can be used for various transactions and have gained recognition as a store of value, their legal status, and acceptance as a medium of exchange differ across countries.

Some view cryptocurrencies as a legitimate alternative to traditional currencies, while others remain skeptical due to regulatory concerns and price volatility.

3. What is the difference between Bitcoin and cryptocurrency?

Bitcoin is a specific type of cryptocurrency, and the terms are often used interchangeably.

However, it's crucial to understand that Bitcoin was the first cryptocurrency, created in 2009 by an anonymous person or group known as Satoshi Nakamoto. On the other hand, the term "cryptocurrency" encompasses a broader category of digital currencies beyond Bitcoin.

Various cryptocurrencies have emerged since Bitcoin's inception, each with its unique features, purposes, and underlying technologies.

Bitcoin remains the most well-known and widely used cryptocurrency, serving as a digital alternative to traditional currencies, while other cryptocurrencies offer different functionalities, such as smart contracts or enhanced privacy features.

Comments

Share Your Feedback

Your email address will not be published. Required fields are marked *