Welcome to a brave new world! In this world, decisions are made democratically through blockchain technology and smart contracts. Every stakeholder here has a say in the organizational structure. There is no red tape, no central authority, and no bureaucracy.

Welcome to the world of Decentralized Autonomous Organizations, or DAOs, as we popularly know them.

DAOs represent a shift in organizational governance. They utilize blockchain to facilitate democratic and transparent decision-making, eliminate central authority, automate operations via smart contracts, and enable collective resource management.

Started thinking of DAOs as a magic bullet? DAOs have more to them than what meets the eye.

Their history, for instance, is also marked by murky events, beginning with the 2016 The DAO hack. Such events have repeatedly highlighted the complexities of operating in a decentralized environment, especially the need for enhanced security and regulatory frameworks within the industry.

In today's blog, we at Global Blockchain Solution will dig deep into DAOs, what they are, and how they work while also walking you through some of the real-world examples.

This Article Contains:

What Is a Decentralized Autonomous Organization (DAO)?

Imagine a company without a CEO or a board of directors. This company is run based on a set of predefined rules. Decision-making is left to all members of the company, who then vote to form a consensus.

What will be the quarterly plan? What color will the new product packaging be? Upon registering all votes, the company automatically makes decisions based on this consensus.

This was DAO for you in a nutshell.

Yes, DAO, an abbreviation for Decentralised Autonomous Organization, operates without a central governing authority. Instead, it relies on collective decision-making to further a common interest most transparently.

This makes the mind go racing with a lot of questions.

How can an organization operate independently? Who registers the votes? Who are these so-called "members", and how are they notified? How and where are the decisions then implemented? And, above all, how does this "autonomous organization" know when a decision is required?

We will answer all of these questions. Let's begin by decoding what each term of a DAO implies.

1. Decentralized

The term "decentralized" here refers to the lack of central authority or control. DAOs distribute the decision-making power across all its members, who often hold tokens granting them vote share.

This approach also promotes transparency and inclusivity, as every vote, action, and transaction is recorded on the blockchain and is accessible to all members for review and audit.

2. Autonomous

"Autonomy" in DAOs is achieved through the use of smart contracts. These are self-executing programs with the terms of the agreement directly written into their code. So, if certain conditions are met, these smart contracts autonomously implement the predetermined tasks without manual intervention.

Such conditions can include issuing RFPs to third-party vendors for product marketing, framing new HR policy, venture capital firms making investment decisions, a team determining the product margins, and so on.

This level of automation speeds up the entire decision-making process by reducing the dependency on human administrators and minimizing the potential for errors, omissions, and biases.

At this stage, you might also want to know how such proposals for smart contracts come into effect on DAO. We will touch on that topic shortly.

3. Organization

Finally, the "organization" aspect entails a group of individuals or entities coming together under a common purpose or goal. Members of a DAO typically contribute resources, like capital or expertise, and in return, receive tokens representing their voting power and ownership stake in that establishment.

This structure fosters a community-driven environment where members are motivated to act in the organization's best interest, as they directly benefit from its success. It's a win-win situation for all.

Through collective decision-making, DAOs can harness their members' diverse perspectives and skills, leading to more innovative and effective solutions to their objectives.

How Do DAOs Work?

It's clear by now that this novel form of governance and organizational structure is set up on a blockchain, typically Ethereum, through a combination of smart contracts and consensus mechanisms. Now, let's break down how it works.

Step 1: Formation of the DAO

The first step in creating a DAO is to define its mission and goals. This is mostly done by a group of initial members who also decide on the rules and parameters of the DAO. These rules are then encoded into a series of smart contracts on the blockchain.

Step 2: Issuance of Tokens

Once the DAO is set up, tokens are issued. These tokens represent a member's stake in the DAO and grant them voting rights.

The tokens can be distributed in various ways, such as through a public sale (an Initial Coin Offering or ICO, sometimes also referred to as DAO offerings or DAO raises), a private sale, or even airdropped to potential members.

Also Read: IPO Vs. ICO Vs. IEO Vs. STO: What's The Difference?

Step 3: Proposal Submission

Any member of the DAO can submit a proposal for a project or initiative that aligns with the DAO's mission. The proposal could cover a wide range of topics, such as changes to governance parameters, fund allocation, project funding, protocol upgrades, or community initiatives.

But are all proposals even necessary or feasible?

To gauge this, these proposals may also include details such as the rationale behind them, objectives, implementation plan, budget, and any other relevant information. Clear and comprehensive proposals help members understand the purpose and potential impact of the proposed policy.

This proposal is then open for discussion and scrutiny by all other members of the DAO.

Step 4: Voting

After a certain period of discussion, a vote is held. Each member can vote on the proposal, with their vote's weight being proportional to the number of tokens they hold.

The proposal is approved if it receives a majority (or other predefined threshold) of the votes. Let's say a DAO has a 60% threshold for decision-making. So, if 60% of members are in favor, the company is going for a rebranding.

Step 5: Execution of the Proposal

If the proposal is approved, the DAO's smart contracts automatically execute it. This could involve releasing funds for a project, changing the DAO's rules, or taking any other action specified in the proposal.

Step 6: Ongoing Governance

The DAO continues to operate and evolve through this cycle of proposal, discussion, voting, and execution. Members can join or leave the DAO, buy or sell tokens, and submit new proposals.

Remember, setting up a DAO is a business decision and not a legal requirement.

Real-World DAO Examples

In the last section of this blog, we will see different kinds of decentralized autonomous organization structures serving various fields such as finance, prediction markets, digital currency, and open-source development.

Let's begin with the first blockchain-based DAO ("The DAO" ):

1. The DAO (Decentralized Autonomous Organization)

Launched in 2016 on the Ethereum blockchain, The DAO was the first DAO ever built, so to speak. It aimed to operate as a decentralized venture capital fund, allowing token holders to vote on investment decisions.

The DAO raised substantial money during its initial coin offering (ICO), collecting 12.7 million Ether (ETH), valued at around $150 million.

This made it one of the largest crowdfunding campaigns in history. However, The DAO faced a significant security vulnerability that led to a controversial hard fork of the Ethereum blockchain.

Some believe that this hack and the following chain of events were critical in shaping Ethereum, making it more secure and robust.

2. MolochDAO

MolochDAO is a DAO that has been designed with a specific purpose: to fund and foster the development of Ethereum infrastructure.

Launched on the Ethereum blockchain in 2019, Moloch DAO has been instrumental in supporting a range of projects, contributing to the growth and evolution of the Ethereum ecosystem. It has awarded grants to initiatives like DApp Node, Ethereum Cat Herders, Tornado Cash, Lodestar, Lighthouse, clr.fund, and more.

What sets Moloch DAO apart is its innovative governance mechanism. It employs a concept known as "rage quitting" to streamline decision-making and minimize coordination issues. This approach allows members who disagree with a decision to exit the organization and take their funds.

Members of Moloch DAO are not just passive investors. They are active participants, contributing capital to give it all away to fund Ethereum infrastructure. Their voting power helps the community make a meaningful impact.

In essence, Moloch DAO is more than just a funding platform. It's a community of thinkers and builders working together to shape the future of Ethereum.

3. MakerDAO

MakerDAO is a revolutionary Ethereum-based decentralized finance (DeFi) platform.

At the heart of MakerDAO is Dai, a stable, decentralized currency that aims to track the price of the U.S. dollar. Dai is unique because it's an unbiased currency that anyone can use anywhere, anytime. It offers financial freedom without volatility.

MakerDAO is not just about creating a stable digital currency. It's also about creating a community. The Maker Protocol powers Dai and is governed by a community of MKR token holders. MKR is the native token of the MakerDAO ecosystem.

This means that the development and future of MakerDAO are in the hands of its community.

Moreover, MakerDAO is a credit facility that offers loans at fixed interest rates. These loans are based on the stablecoin Dai, created via the Maker Protocol. The process begins with an Ethereum deposit into a Maker smart contract, creating a collateralized debt position (CDP).

4. Aragon

Another Ethereum-based project, Aragon, is a platform for creating and managing decentralized organizations (DAOs). It provides tools for creating DAOs with customizable governance structures and voting mechanisms.

Aragon's core product is the Aragon App, a user-friendly, no-code platform for launching and managing DAOs. It allows users to mint and distribute tokens, authorize wallets for voting, and set governance parameters without writing a line of code. This makes creating proposals and casting votes easy, thereby removing barriers to entry.

The heart of Aragon is its native token, ANT. ANT holders are not just investors but active participants in the governance of the Aragon network. This means that the future of Aragon is shaped by its community.

Aragon also offers Aragon OSx, a modular protocol allowing users to build custom DAOs with plugins. This opens up unlimited potential for extending the governance logic, enabling use cases we can't imagine today.

5. Gnosis

Gnosis is a decentralized platform that builds infrastructure for the Ethereum ecosystem. In late 2020, It announced plans to transition fully into a decentralized autonomous organization (DAO).

As a DAO, Gnosis uses the products it creates to guide the development, support, and governance of its ecosystem. The GnosisDAO treasury controls over 150,000 ETH and 8 million GNO tokens, with the GNO tokens vested over 8 years.

GNO is the native token of the Gnosis ecosystem and the governance token for the GnosisDAO. This allows anyone to participate in decision-making about the platform's development.

One key Gnosis product is the Gnosis Chain, one of the first Ethereum sidechains. Secured by over 200,000 validators, Gnosis Chain enables contributors worldwide to easily run a node, ensuring the sidechain remains credibly neutral.

The Gnosis mission has always centered on experimentation and building decentralized infrastructure for the Ethereum ecosystem. As a DAO, the platform aims to further decentralize its development and governance, empowering the broader community.

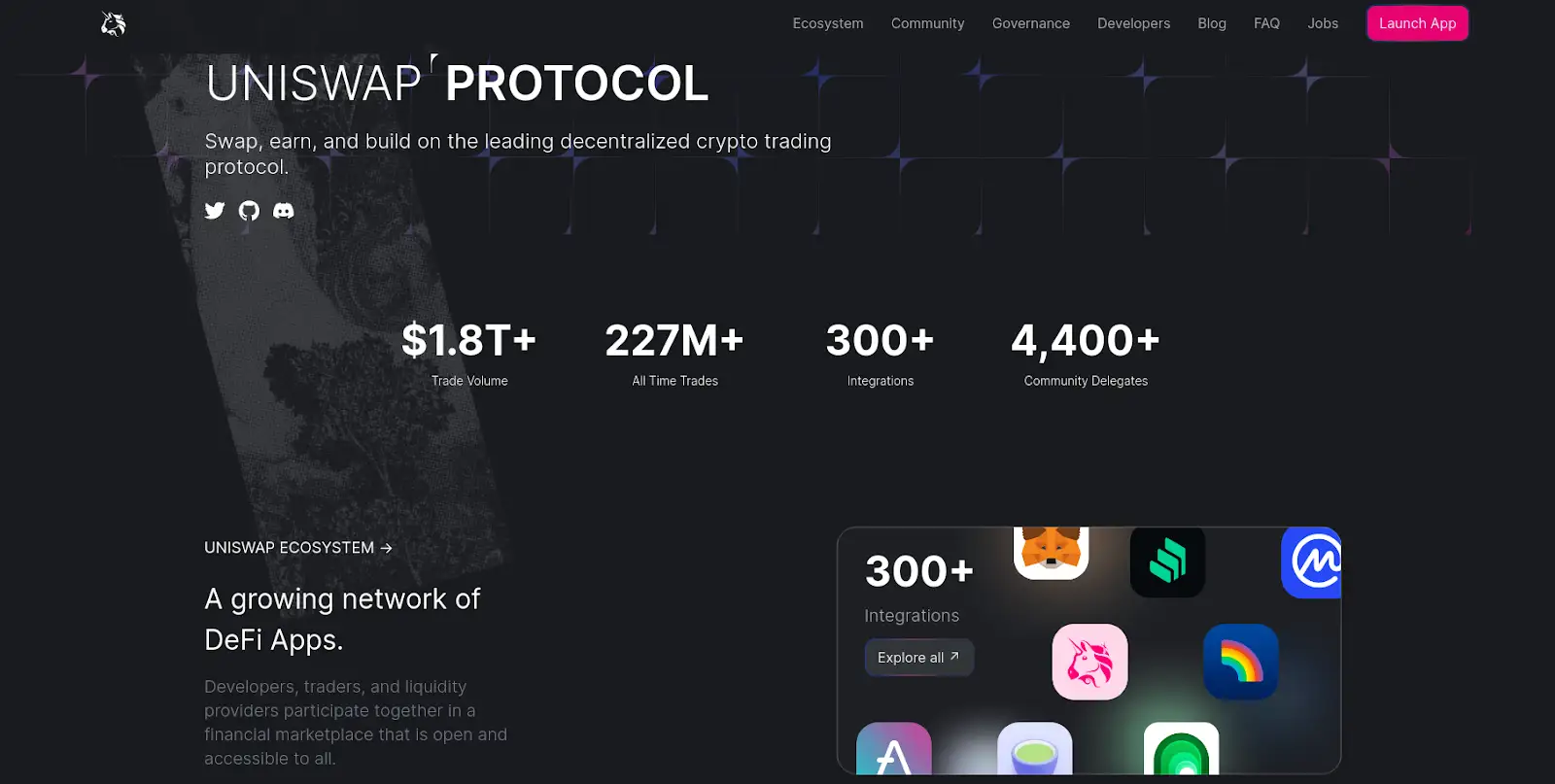

6. Uniswap

A decentralized marketplace where Ethereum (ETH) tokens can be traded, Uniswap's flagship offering is its crypto trading protocol, facilitating over $489B+ in trade volume and 71M+ all-time trades.

It's a platform where developers, traders, and liquidity providers come together to participate in a financial marketplace that is open and accessible to all.

Uniswap's native token is UNI. UNI token holders help govern the Uniswap network. They have the power to propose upgrades and discuss the future of the protocol with the Uniswap community.

Uniswap also offers a Grants Program. This program provides funding for people building apps, tools, and activities on the Uniswap Protocol. It's a testament to Uniswap's commitment to fostering innovation and building the future of finance.

7. Compound Finance DAO

A decentralized finance (DeFi) protocol for cryptocurrency lending and borrowing in a transparent and permissionless manner. It provides a platform where users can supply assets (like stablecoins or other tokens) and earn interest while allowing others to borrow those assets.

COMP token holders are DAO members who contribute to the governance of the Compound network. They may propose or vote for protocol changes.

Compound also offers liquidity mining, a mechanism that rewards users who supply and borrow tokens with additional COMP tokens. It's a way to incentivize participation and ensure the protocol remains liquid.

8. MetaCartel

At the core of MetaCartel is a supportive ecosystem of creators and builders at the forefront of web3 and DAOs. It's a platform where innovators come together to create futuristic DApps.

The DAO issues significant grants to teams and individuals working on user-focused projects within the Ethereum infrastructure, making the MetaCartel community-driven.

MetaCartel also offers a unique feature known as MetaCartel Ventures. This venture aims to help founders, builders, engineers, and others raise the necessary capital for their current or future ventures. It has invested in various projects, either as (pre-)seed, Series A, or OTC rounds.

9. DASH

A digital currency that operates on a self-governing and self-funding model, Dash DAO has a unique Decentralized Governance by Blockchain (DGB) functionality, a feature that allows anyone to propose changes to Dash. Such proposals range from marketing and community-based decisions to direct modifications to the Dash protocol.

The Dash DAO is powered by masternodes, a subset of its users. These masternodes host monthly votes on these proposals. Dash DAO's project budget is funded by 10% of the block reward. This revenue is deposited into a fund that can be used to finance projects approved by Dash's masternodes.

Dash's project funding model is self-sustaining and network-centric. Funds are generated internally through the mining process and then allocated to initiatives by the masternode network. This approach promotes the overall strength and development of the Dash network, creating a virtuous cycle of internal capitalization and protocol improvements.

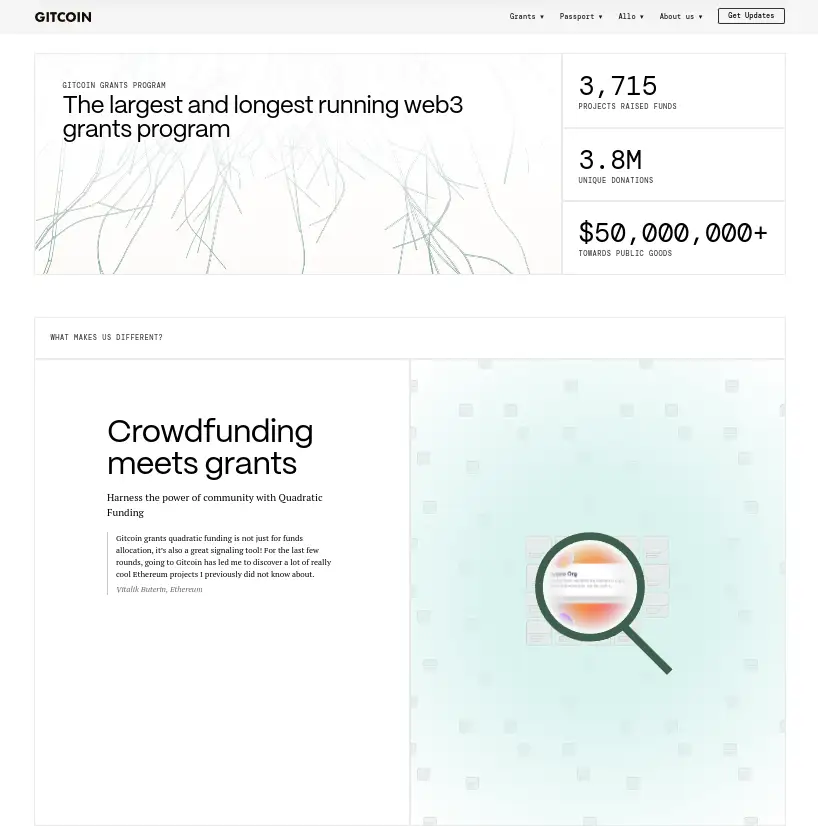

10. Gitcoin

A Web3 platform supporting open-source projects through crowdfunding and NFTs. At its core, Gitcoin is structured as a decentralized autonomous organization (DAO) built on the Ethereum blockchain.

The primary mission of the Gitcoin DAO is to build and fund digital public goods that benefit the broader web3 community. Gitcoin empowers diverse communities of builders to collaborate and create the next generation of open-source technologies and applications.

The Gitcoin DAO's governance is facilitated through its native GTC token. GTC holders are not merely passive investors, but active stakeholders who shape the platform's development. They can propose changes to the Gitcoin protocol and vote on these proposals, directly participating in the decision-making process.

A standout feature of Gitcoin is its use of "quadratic funding" - a mechanism that rewards contributors to the ecosystem based on the breadth of support their projects receive. This innovative funding model exemplifies Gitcoin's commitment to fostering decentralized innovation in the world of decentralized finance.

Through its DAO structure, token-based governance, and unique funding approaches, Gitcoin is pioneering new models for collaboratively developing and sustaining critical digital public infrastructure within the web3 space.

In essence, a DAO is a dynamic, member-driven organization that uses the transparency and efficiency of blockchains to facilitate collective decision-making and resource management. This revolutionary concept has the potential to redefine how we think about and structure organizations. However, it's also a complex and evolving field with many challenges and risks.

If you have any queries, feel free to contact us or get a free 15-minute consultation with Global Blockchain Solution experts.

In the next blog, we will discuss the benefits, limitations, and regulations surrounding DAOs. We will also find out how they are launched and how they make money. Stay tuned!

Frequently Asked Questions

1. What do DAOs do?

DAOs, or Decentralized Autonomous Organizations, operate on blockchain technology to enable a fully democratic governance structure. They automate decision-making and operations through smart contracts, allowing for transparent and collective management of resources without a central authority.

This system helps ensure that all actions and transactions are recorded and open for member review, promoting transparency and accountability.

2. What is an example of a DAO?

One well-known example of a DAO is "The DAO," which was launched in 2016 on the Ethereum blockchain. It was designed as a decentralized venture capital fund, allowing token holders to vote on investment decisions. Despite facing security challenges, it marked a significant development in the use of DAOs for managing investments collectively and democratically.

3. What is DAO used for?

DAOs are primarily used to manage and govern organizations, projects, or funds in a decentralized manner. By utilizing blockchain technology and smart contracts, DAOs facilitate democratic decision-making processes among stakeholders, automate administrative tasks, and ensure transparency and security in operations.

This makes them suitable for a variety of applications, including venture capital funding, charity, community management, and even complex organizational governance.

Comments

Share Your Feedback

Your email address will not be published. Required fields are marked *