Ever since their debut in 2013, ICOs, or Initial Coin Offerings, took the world by storm. In 2017 and 2018, the investments raised by businesses were north of $14 billion. But, by then, it had started becoming apparent that launching a crypto token was not going to mean just creating a website and releasing a whitepaper. Proper legal scrutiny by tokenization companies should now be ensured.

Reason? Countries across the globe, even the most supportive ones, were coming up with their own set of regulations. The U.S. institutions such as the Securities and Exchange Commission (SEC), Financial Crimes Enforcement Network (FinCEN), the Commodity Futures Trading Commission (CFTC), and various states in the U.S. led the charge.

The SEC even halted the ICO token sale of Munchee, a California-based company selling digital tokens, in 2017. The company had to ultimately return all of its ICO proceeds back to the investors. Since then, there have been several similar instances wherein the crypto promoters were penalized , or even worse, arrested and prosecuted for not following the regulatory mandates.

To this day, the legality of ICOs is oddly overlooked by crypto enterprises . In light of the tightening regulations, it’s essential to ensure the legal validity of launching a crypto token and the associated risks.

At Global Blockchain Solution , we are passionate about everything related to cryptocurrencies and blockchain. We have a team of experts that knows all the ins and outs of tokenization and turn them into successful ICOs. We’ve helped numerous businesses, and today, we’re going to discuss the importance of legal compliance in your Initial Coin Offering, and how to ensure you’re on the right side of U.S. laws.

This blog is part of a series discussing the regulatory landscapes of various nations (the U.S. in this case). So, if you’re interested in other regions as well, make sure to subscribe to our newsletter.

Alright. Buckle up now! It's time to embark on an exciting journey to the world of Initial Coin Offering. Let's go!

Crash Course into ICOs

Before we begin, let’s first dabble into what ICOs are. While the term ICO, or Initial “Coin” Offering, inherently implies the digital assets to be cryptocurrencies or digital coins, they are not. Cryptocurrency tokens are just one of the many types of tokens that can be issued through an ICO.

They are classified into three broad categories, namely

1. Cryptocurrency Tokens

These are the “cryptocurrencies” as we know them. They are used as a “medium of exchange” and primarily represent a monetary value. Cryptocurrencies are financial denominations in true sense. Some examples include Bitcoin (BTC), Ripple (XRP), and Tether (USDT).

2. Utility Tokens

The tokens that can be used within some specified ecosystem or application are called utility tokens. Suppose you launch a crypto social media platform. You can launch its native token and sell it to the users in the form of a crypto utility token ICO. The users can use this token to purchase premium services or access exclusive content.

For instance, Chainlink (LINK), an ERC-20 utility token, serves the purpose of providing real-time price data to blockchains and decentralized applications. Similarly, Binance Coin (BNB) empowers Binance customers to get a 25% discount on trading fees by paying through it. However, in the case of Binance, it must be noted that it is both a cryptocurrency and a utility token.

3. Security Tokens

Launched through an STO, or Security Token Offering, security tokens are similar to stocks, bonds, derivatives, and other securitized assets and must follow security token regulations.

Basically, these tokens represent some kind of ownership or "security". A company can issue security tokens that can be purchased by the investors, who, in turn, can get access to something like the profits made by the company.

Similarly, security token companies can issue dividends, interest, or other forms of proceeds. Since they are securities, they generally fall within the purview of the security regulatory framework of a country (such as SEC, ESMA, etc.)

Vevue, a rewards-based social media video app, is a good example here. It has an ERC1404-compliant token called VUE, which is non-digitized and extends non-voting preferred equity share of Vevue Media, Inc. Similarly, the tokenized real estate investment platform, Harbor, has a crypto security token that represents the ownership of a real estate asset.

Now that we know what ICOs are and what they represent, let’s take a look at an interesting development that changed the U.S. and even the international ICO market forever.

The Munchee Files: ICOs can be STOs

In July of 2017, the SEC released a report that stated most tokens sold in ICOs are securities. As a result, it warned the market players who didn’t comply with federal securities laws of severe consequences.

And the regulator wasn’t just goofing around. In December of the same year, the SEC brought a case against an ICO by Munchee Inc. halting the offering and forcing the company to refund its proceeds to all investors. The case is interesting as Munchee’s token (MUN) wasn’t a security token. It was supposed to be a utility token used in Munchee’s smartphone app for restaurant reviews.

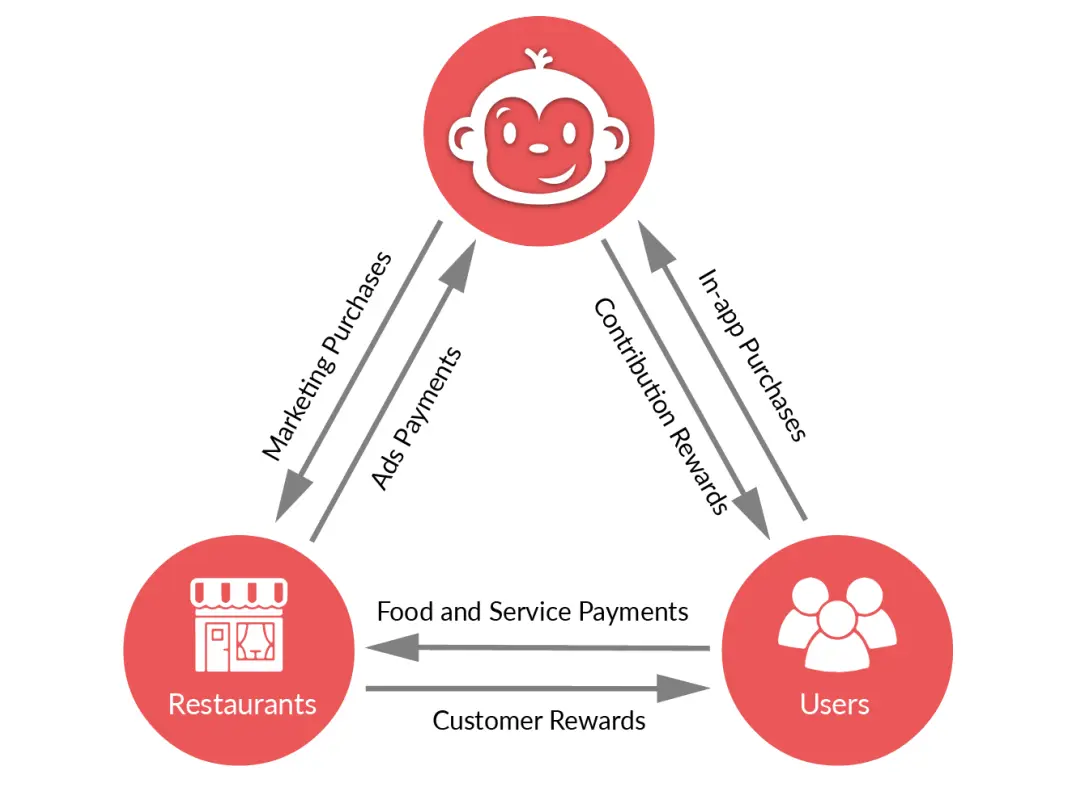

The company’s white paper declared that users could purchase the token to buy in-app services. For instance, if a user wanted to promote their business via the Munchee app, they would need to purchase the MUN token.

To be honest, Munchee perfectly fits the bill of a utility token. But there’s more than what meets the eye here. And, the vigilant SEC was quick to notice. However, in its investigation, the SEC deemed MUN as a security token. It met all the conditions of the Howey Test, which, in the U.S., is used to determine whether any asset is a security or not.

The Howey Test: Hey ICO, Howey Doin?

The Howey Test takes its name from the 1946 case SEC v. WJ Howey Co. The Supreme Court in this case stated that an investment contract can be considered a security if it satisfies the following four conditions:

There is an investment of money

There is an expectation of profits from the investment

The investment is in a common enterprise

Any profit comes from the efforts of a promoter or third party

Munchee and the Howey Test

In the case of Munchee, the SEC found that the company’s ICO met all four conditions of the Howey Test.

The SEC delved particularly into the second (expectation of profits from the investment) and fourth criteria (any profit comes from the efforts of a promoter or third party) during its examination.

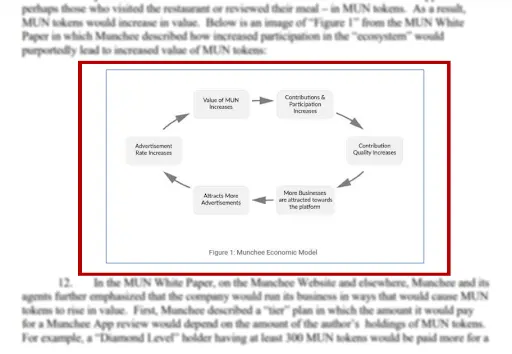

The case in point was official statements made by Munchee and its associates guaranteeing substantial returns to the MUN investors. The fundraising begun to enhance the application and build an “ecosystem” for the relevant use cases (ad purchases, interviews, food sales, and other in-app transactions).

Additionally, the regulator was apprehensive of Munchee's incentives to third parties for the promotion of the MUN token sale. These incentives motivated over 300 individuals to promote Munchee’s up-and-coming ICO on social media platforms.

While celebrity crypto endorsements were a norm back then, SEC’s stance was that “endorsements may be unlawful if they do not disclose the nature, source, and amount of any compensation paid, directly or indirectly, by the company in exchange for the endorsement.”

What rubbed it in for the SEC was that Munchee didn’t primarily target the existing users of the Munchee app or restaurant proprietors (or those in the food service industry). It targeted investors curious about ICOs and digital assets instead. Hence, the token sale met all the conditions of the Howey Test with flying colors.

Ultimately, Munchee had to wind down its multi-million-dollar ICO following SEC’s cease-and-desist order. Since then, the SEC has filed numerous motions and complaints against the ICOs it believes to be securities.

So, what are the takeaways here? For one, it’s important to know the latest guidelines issued by the relevant authorities. Secondly, even if an asset appears to be a utility token at the outset or is promoted as such, it may not necessarily be so. Everything ultimately depends on the relevant legal interpretations, even of the third-party engagements of the token issuing firm.

William Hinman, Director, Division of Corporation Finance, SEC says that, “The economic substance of the transaction always determines the legal analysis, not the labels used by the promoter.”

An SEC report also states that “a digital asset may be offered and sold initially as a security because it meets the definition of an investment contract, but that designation may change over time if the digital asset later is offered and sold in such a way that it will no longer meet that definition.”

Since the Munchee incident, other nations have also followed the suit and come up with their own regulatory frameworks as the checks and balances. Some of the first-movers include Japan Italy, Canada, Singapore, El Salvador, Malta, Brazil, China, and India .

The US Regulatory Landscape in 2023

Although it is among the first few nations to be dabbling with blockchain technology and cryptocurrency, the U.S. has taken a cautious approach towards regulating them. This is primarily because of the sheer number of ICO scams that have plagued the market.

At present, cryptos may come under the jurisdiction of four bodies:

FinCEN

Ensures digital assets comply with Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT) regulations to prevent illegal financial activities.

SEC

Monitors the issuance and trading of digital assets that are classified as securities to protect investors

CFTC

CFTC regulates digital assets that have characteristics of commodities or are used as derivatives to maintain fair and transparent markets.

State Departments

State departments ensure digital assets are used in accordance with state and local laws.

How Does it Work?

These bodies are responsible for issuing relevant approvals to the crypto players. For instance, Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) obligations may apply to entities defined as "financial institutions" under the Bank Secrecy Act (BSA) . This includes money services businesses, securities brokers/dealers, futures commission merchants, introducing brokers in commodities, and mutual funds, among others.

In 2019, FinCEN released guidance stating that the BSA may apply to certain business models involving digital assets, such as P2P exchangers, hosted wallet providers, multiple-signature wallet providers, operators of Convertible Virtual Currency (CVC) kiosks, DApps performing money transmission, providers of anonymizing services for CVCs, payment processing services involving CVC money transmission, and CVC money transmission performed by internet casinos.

In 2021, the Anti-Money Laundering Act (AMLA) amended the BSA to expand the definition of "financial institutions" and include "value that substitutes for currency". This means that businesses engaged in the exchange of currency, funds, or equivalents, as well as those who engage in the transmission of currency, funds, or equivalents, are now considered financial institutions.

Similarly, according to CFTC, its jurisdiction “is implicated when a virtual currency is used in a derivatives contract, or if there is fraud or manipulation involving a virtual currency traded in interstate commerce.”

However, the most important regulations for cryptocurrencies are from the SEC, especially during the ICO launch.

In a nutshell, if you want to launch a crypto token without any hindrances in the U.S., you must follow all the applicable guidelines.

While you can launch an ICO in other nations more freely than in the U.S., it’s best to follow the SEC guidelines. It gives you higher credibility in the crypto community, which means your token will have more chances of success.

The United States Crypto SEC Framework: Reg A+, Regulation CF, and Regulation D – Know Your Options!

There are many ways you can go ahead with your Initial Coin Offering while maintaining compliance with SEC laws and regulations.

Let’s take a look at them:

1. Regulation A+ (Reg A+)

According to Reg A+, crypto businesses can raise funds up to $20 million (Tier 1) or $75 million (Tier 2) from global investors via public offerings within one-year period through a general solicitation (broadcast media).

The companies may (Tier 2) or may not (Tier 1) require audited financials. The Tier 1 accreditation, however, requires compliance with Blue Sky laws in each US state that investors live in, which is very time taking. The Tier 2 accreditation, on the other hand, limits investments by non-accredited investors to 10% of their gross annual income.

2. Regulation Crowdfunding (Reg CF)

Through Reg CF, U.S.-based startups and small businesses can raise up to $5 million from accredited investors annually via online platforms registered with FINRA or SEC. The offerings are not required to get audited financials initially but may have to do so if the crowdfunded amount exceeds $618,000.01 or $1.235 million within 12 months of the offering’s launch.

They also need a way for customers who want their money back during the first year after funding has been completed – something that is crucial in case you don’t meet your goals on time and require an extended period for refunding purposes.

3. Regulation D (Reg D)

Regulation D has two subparts, 506(b) and 506(c), which serve as two separate exemptions.

The 506(b) exemption allows for an unlimited amount of capital to be raised. It permits an unlimited number of accredited investors and up to 35 sophisticated (but unaccredited) investors, but requires a pre-existing, substantial relationship with all investors. This means that the issuer must have known the investor before the security offering and have knowledge of their investor status and reasons for being classified as accredited or sophisticated.

The 506(c) exemption similarly enables an unlimited amount of capital to be raised, and allows for an unlimited number of accredited investors. However, only accredited investors are allowed, meaning sophisticated investors cannot participate. The 506(c) exemption does not have a pre-existing relationship requirement, allowing for general solicitation and advertising to sell the security.

Also Read: How to create your own crypto app?

Final Thoughts

So, should you launch your crypto token in the U.S.? Well, yes! If you follow all the regulations laid out by the SEC and other relevant authorities when launching your ICO or STO, there’s no reason not to!

Doing so will not only protect your business from any legal consequences but will also help you gain credibility in the crypto community. People are more likely to invest in an ICO that has been approved by a relevant authority than one that hasn’t.

And, if you want someone who knows what they’re doing, we can surely be of help! Global Blockchain Solution is a leading blockchain development company with years of experience launching successful ICOs for businesses all around the world.

Feel free to ask us any queries that you may have! Contact us here .

All the best for your journey! Godspeed.

Frequently Asked Questions

1. What is an ICO?

An ICO is a means by which a cryptocurrency or blockchain-based venture can raise capital by selling tokens to investors.

2. Is it legal to hold an initial coin offering (ICO) in the U.S.?

There are various federal and state securities laws that affect the legitimacy of ICOs in the United States. When ICOs register with the SEC or meet the criteria for an exemption and comply with U.S. laws and regulations, they are legal in the United States.

3. What are the regulations that ICOs must comply with in the U.S.?

The Securities Act of 1933, the Securities Exchange Act of 1934, and the Investment Company Act of 1940 are just a few of the federal securities rules and regulations that initial coin offerings (ICOs) must follow. Additionally, securities rules and regulations specific to each state must be followed.

4. Is SEC registration mandatory for all ICOs?

SEC registration is not necessary for all ICOs. The U.S. Securities and Exchange Commission (SEC) requires ICOs to register unless a token falls under one of its exemptions.

5. What are some common exemptions from SEC registration that ICOs can use?

Regulation D, Regulation A+, and Regulation Crowdfunding are all common exemptions from SEC registration that initial coin offerings make use of. To qualify for a given exemption, you must meet its specific conditions.

6. Can ICOs be conducted internationally and still comply with U.S. laws?

Yes, ICOs can be conducted internationally and still comply with U.S. securities laws. However, unless it is registered with the SEC or falls under an exemption from registration, U.S. investors cannot participate in the offering.

7. What are the penalties for violating U.S. securities laws in relation to ICOs?

Fines, injunctions, and criminal prosecution are all possible outcomes for violating U.S. securities laws with regard to ICOs. If an initial coin offering (ICO) doesn't follow U.S. securities rules, investors may also have the right to rescind their investment.

Comments

Share Your Feedback

Your email address will not be published. Required fields are marked *