When people think about the history of blockchain, the first name that pops into their heads is almost always Satoshi Nakamoto. You know, the mysterious figure behind the famous 2008 whitepaper that introduced Bitcoin and revolutionized finance forever.

But here's the thing - the origins of blockchain actually go back way further than Nakamoto's paper. After all, blockchain has evolved through the ideas and innovations of computer scientists for decades.

Satoshi certainly deserves credit for his brilliant contribution, but he was also building on decades of work by other pioneers.

At , we’re passionate about everything blockchain! In this blog, we'll dive into the fascinating history of blockchain before most people were even aware it existed. There are some surprising twists and turns along the way. So, buckle up, blockchain heads! By the end, you'll have a whole new perspective on how this world-changing technology came to be.

This Article Contains:

The Early Days: Cryptography Lays the Groundwork (1980s - 2008)

In 1982, the American cryptographer David Chaum proposed a protocol for a cryptographically secured chain of blocks in his dissertation. While it wasn't a fully decentralized blockchain, it introduced concepts like blocks for bundling data and cryptographic proofs to verify integrity without a central authority. It was groundbreaking research at the time!

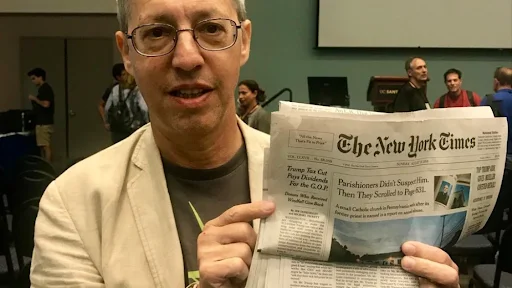

Over the next decade, innovators like Stuart Haber, Scott Stornetta, and Dave Bayer improved on these ideas. They incorporated time-stamping and Merkle trees for more efficient data verification. In 1995, Haber and Stornetta created the world’s first and longest-running blockchain, a time-stamping service called “Surety,” which has been published in The New York Times ever since.

Surety's offering constituted the first commercial deployment of a blockchain and is currently the oldest continuously running blockchain.

Although the world wasn't ready for their inventions then, they were laying the blocks that would eventually form the foundation for blockchain technology.

On the currency side, we saw early digital cash proposals like Wei Dai's B-money in 1998 and Nick Szabo's Bit Gold shortly after. These outlined basic principles of blockchain-based currencies, like using proof-of-work to create decentralized consensus.

While decentralized digital cash was theorized, no one had figured out how to make it work in practice. A huge breakthrough came in the early 2000s from computer scientist Hal Finney. He proposed a system called "Reusable Proof of Work" that allowed digital cash to be reused while preventing double-spending.

At the time, few saw the potential of these innovations. But step-by-step, computer scientists were quietly constructing the framework for peer-to-peer digital cash and trustless computing. Without their pioneering work, Satoshi likely would not have been able to make his breakthrough.

Bitcoin Kickstarts the Blockchain Revolution (2008-2014)

The history of blockchain changed forever in 2008 when Satoshi Nakamoto published the now-famous whitepaper introducing Bitcoin. Finally, all the ideas of previous decades came together in one system - a fully decentralized digital currency secured by cryptographic proofs and consensus rules.

Also Read: Blockchain Explained What is Blockchain Technology?

At the time, trust in financial institutions was at an all-time low following the housing crisis. People were eager for an alternative. Bitcoin offered a way to exchange value without centralized intermediaries or oversight.

When Bitcoin launched in 2009, early crypto enthusiasts began mining and transacting in bitcoins. The first real-world Bitcoin transaction was 10,000 BTC for two Papa John's pizzas in 2010! This marked the first baby steps toward a financial system without centralized control.

Over the next few years, Bitcoin started gaining traction within small online communities. Innovations like the Bitcoin Foundation in 2012 brought more organization and legitimacy. But it was in 2013 when things really hit hyperdrive - with Bitcoin exceeding $1000 in price and receiving massive mainstream media coverage.

Of course, new challenges emerged too. Mt. Gox, once handling 70% of Bitcoin transactions, closed due to a massive hack exposing the risks of centralized exchanges. But resilience prevailed. Despite price crashes and exchange scandals, interest and adoption continued growing.

By 2014, Bitcoin's potential as "digital gold" was clear. Major investments from VC firms like Andreessen Horowitz signaled its future. Bolstered by these early successes, developers started turning their attention to building on Bitcoin's foundations.

Ethereum Opens New Doors (2014-2017)

While Bitcoin introduced the blockchain revolution, Ethereum took it to the next level. Proposed in 2014 by Vitalik Buterin, Ethereum added smart contract functionality on top of the blockchain.

Bitcoin was limited to financial transactions. However, Ethereum allowed decentralized apps and complex programmatic contracts. Instead of just transferring value from A to B, you could codify business logic and conditional statements directly on the blockchain.

These programmable smart contracts, which were self-executing code, enabled the development of decentralized apps (dApps) for finance, collectibles, governance, and more.

After a successful crowd sale in 2014 raising $18.3 million, the Ethereum network went live in 2015. In 2016, The DAO became one of the first large-scale dApps and raised $150 million to invest in Ethereum projects, demonstrating massive demand.

Tragically, vulnerabilities in The DAO's code allowed a hacker to steal $50 million of the funds raised. This caused a debate within the community over whether Ethereum should hard fork to return the stolen funds. The disagreement resulted in a network split into Ethereum (ETH) and Ethereum Classic (ETC).

Despite this setback, Ethereum sparked a tsunami of decentralized application development and speculation. Besides enabling dApps, Ethereum also popularized the concept of ICOs. ICOs allowed blockchain projects to raise funds by selling tokens to investors, rather than traditional equity financing. At first, ICOs operated in legal gray areas. But by 2017, they were raising billions through token sales.

While Ethereum stole the spotlight for some time, Bitcoin continued maturing in parallel. By 2017, Bitcoin’s blockchain had grown to over 100GB while daily transaction volume reached 350,000 on average.

Mainstream Adoption and Crypto Evolution (2017 - Present)

Blockchain technology entered the mainstream spotlight between 2017-2021, with cryptocurrency prices skyrocketing and major companies exploring applications.

In 2017, Bitcoin exceeded $10,000 for the first time even after starting under $1,000 that year. As mainstream interest exploded, derivatives like Bitcoin futures were approved by the CME, and celebs like Paris Hilton promoted ICOs. Countries took notice, with Japan recognizing crypto exchanges in 2017.

Seeing the growth, companies rushed to pursue blockchain projects. IBM and Microsoft began offering blockchain services to clients. Facebook assembled a blockchain team and unveiled plans for "Libra" (later rebranded to Diem), a global stablecoin-based payments network.

In 2018, crypto prices plunged, but underlying development continued. Ethereum's Constantinople upgrade introduced optimizations and Bitcoin's Lightning Network saw growth for cheaper transactions. However, ICOs declined in popularity due to increased regulatory scrutiny and enforcement.

Also Read: The Legality of Launching an ICO in the US in 2023

The focus shifted to enterprise adoption in 2019. Walmart emerged as a pioneer in using blockchain for tracking food sourcing. JPMorgan and Wells Fargo tested blockchain for cross-border payments. However, Facebook's Libra faced regulatory pushback over concerns about its impact on monetary policy and financial stability.

In 2020, major institutions waded into crypto as the pandemic accelerated digital payment interest. Square and MicroStrategy invested in Bitcoin. PayPal announced support for buying, selling, and holding cryptocurrencies. Central banks began researching CBDCs.

The frenzy reached a fever pitch in 2021. Crypto market value exceeded $3 trillion, Tesla invested $1.5 billion into Bitcoin based on its "long-term potential", and El Salvador adopted it as legal tender after lobbying by President Bukele. NFTs swept the internet, with Beeple selling an NFT for $69 million at Christie's auction house.

However, this mainstream adoption also brought increased scrutiny. China outright banned crypto mining and trading in 2021, citing financial stability risks. As crypto prices swung wildly, the environmental impact of proof-of-work mining came under examination.

In 2022, "crypto winter" set in with prices plunging over 70% from November peaks. Major companies like Celsius, FTX, and Genesis collapsed amid liquidity issues and insolvency. The Tornado Cash mixer was sanctioned by the US Treasury, provoking debates around blockchain privacy. Skepticism rose but development continues.

On September 15, 2022, Ethereum completed its long-awaited “merge” to proof-of-stake, promising about 99.95% less energy usage. Regulations evolved with the EU’s MiCA framework and executive orders in the US laying the groundwork for balanced oversight. Despite market volatility, blockchain technology continues maturing across areas like DeFi, DAOs, and Web3.

Now, blockchain's potential to transform finance, business, government, and more seems inevitable.

This technology has been over 40 years in the making, requiring patience as its evolution continues. Accelerated developments throughout the history of blockchain technology indicate that the next decade will be just as eventful as the last.

The Way Forward

After four decades of evolution, blockchain technology stands poised to genuinely transform multiple industries and aspects of society. But realizing that potential will require overcoming ongoing challenges.

Scalability remains an issue limiting mainstream adoption. Leading blockchains like Ethereum can still only process 10-20 transactions per second - nowhere near major credit card networks. A few networks like EOS, Solana, Cosmos, and even Ethereum 2.0 seem to solve this issue, but other challenges such as scalability and reliability remain to be an issue.

Various solutions like sharding, sidechains, alt-layer protocols, and more are being deployed to address such challenges. We can expect steady progress, but scalability will remain a moving target as demand grows.

Privacy and regulation also need resolution. Truly decentralized blockchains offer pseudonymity at best. New cryptographic approaches like zero-knowledge proofs can enhance privacy but may face regulatory pushback as authorities demand transparency. Striking the right balance will allow the confidence and oversight needed for mainstream legitimacy.

Energy usage also persists as a hurdle. Proof-of-work mining is tremendously wasteful. Proof-of-stake and other consensus models offer much greener alternatives. Their continued adoption could enable blockchains to positively impact sustainability.

Also Read: What is Consensus Mechanism? 25 Consensus Mechanisms to Choose From

Interoperability solutions will also be key. Fragmented, siloed blockchains are harder to use at scale. Platforms like Polkadot that bridge across chains can stitch this into an internet of blockchains - a seamless ecosystem.

And of course, new applications and business models will emerge. NFTs and DeFi are just the beginning. Blockchain’s unique attributes like trustless automation, transparency, and tokenization make possible innovations not even conceivable yet.

After 40 years of tinkering, blockchain is ready for the big leagues. But work remains to make it truly mainstream.

With ongoing progress, investment, and adoption, its revolutionary potential can be realized over the coming decades across industries, transforming commerce, governance, and society.

The next 40 years for blockchain promise to be even more exciting than the first.

Key Events in the History of Blockchain

Let a professional blockchain development service provider ease the development process for you. Contact us to tap into the prowess of our team of tech, legal, and marketing experts.

Frequently Asked Questions

1. Did blockchain exist before Bitcoin?

Yes, blockchain technology existed long before Bitcoin. The origins of blockchain can be traced back to the 1980s when cryptographers like David Chaum first proposed blockchain-like protocols. However, it wasn't until the 2008 Bitcoin whitepaper that all the pre-existing ideas came together into the first fully decentralized and widely adopted blockchain system.

2. When and why was blockchain created?

The earliest ideas for blockchain emerged in the 1980s as computer scientists tried to develop cryptographic systems for verifying information and transactions without needing centralized authorities.

Some key milestones were David Chaum's blockchain-like protocol proposal in 1982 and Stuart Haber and Scott Stornetta's work on cryptographic timestamps using blockchains in 1991. However, blockchain technology was truly created with the launch of Bitcoin in 2009.

Bitcoin's creator Satoshi Nakamoto combined previous innovations like cryptographic proofs, distributed ledgers, consensus mechanisms, etc. into one decentralized system not dependent on third-party trust. This allowed a digital currency to be sent peer-to-peer without centralized oversight.

3. What is the oldest running blockchain?

The earliest running blockchain is actually Surety's blockchain, which was created in 1995 by Stuart Haber and Scott Stornetta. Surety's private blockchain was designed to timestamp digital documents as proof of existence.

Though not widely known, Surety's blockchain predates the public Bitcoin blockchain by over a decade and is published in The New York Times. Bitcoin's blockchain was launched in 2009 and became the first widely adopted public permissionless blockchain.

Comments

Share Your Feedback

Your email address will not be published. Required fields are marked *