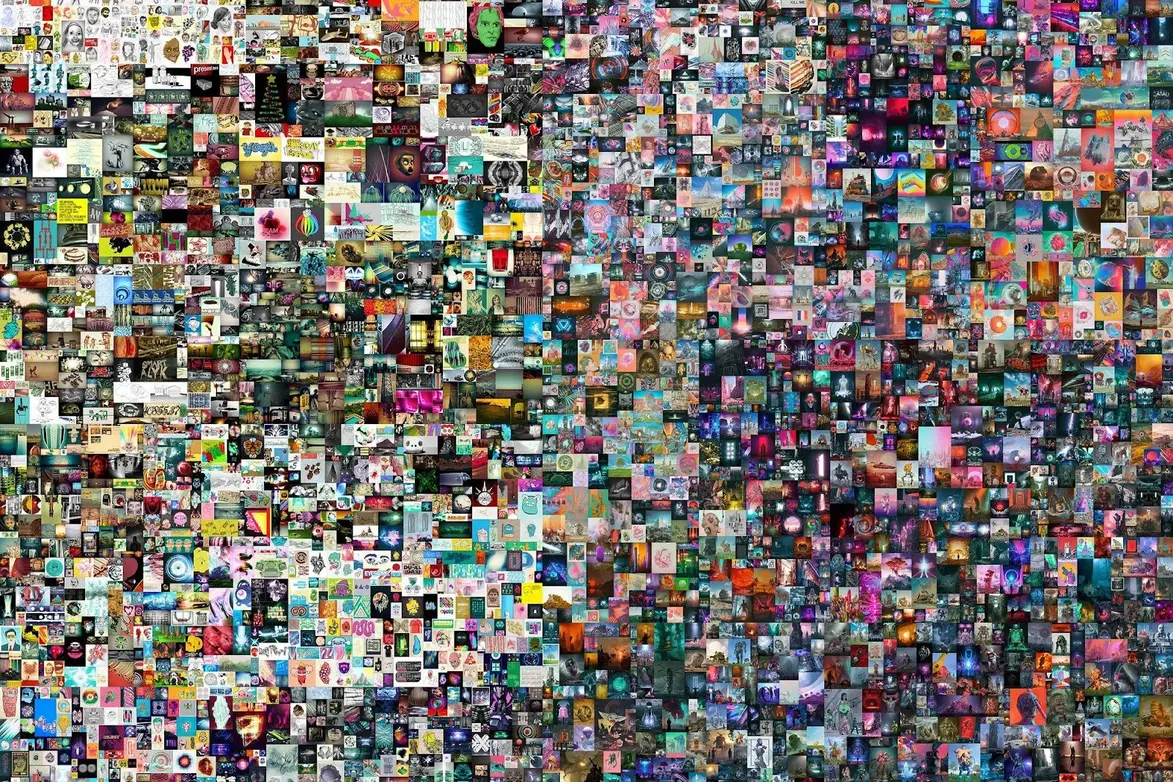

In 2021, the digital art realm witnessed a seismic shift. Beeple's artwork, "Everydays - The First 5000 Days", fetched a whopping $69.3 million at Christie's, placing itself as the fourth most-expensive piece ever sold at auction by a living artist. Not long after, digital artist Pak's "The Merge" reset the boundaries, aggregating to a colossal $91.8 million on the NFT platform Nifty Gateway.

However, instead of catering to the uber-rich alone, Merge tokens began at a mere $299, allowing a broader audience to partake. As the sale progressed, the token price increased by $25 every six hours, culminating in an aggregate sale of $91.8 million. Astonishingly, 28,983 collectors acquired 312,686 total units of this mass, or non-fungible token (NFT).

Now imagine democratizing access to every tangible and intangible asset. This radical vision is closer than ever, thanks to asset tokenization. By representing asset ownership on blockchains, tokenization slices up value, opening the door to fractional ownership. Savvy collectors can own slivers of a Basquiat or Warhol without requiring nine-figure net worths.

And, the potential extends far beyond fine art. Real estate, stocks, commodities, souvenirs, goods, images, and even a Tweet someone made some time ago - assets once siloed by borders, bank accounts, and other limitations - could become universally tradable, 24/7, via blockchain-powered tokens. Yet, questions loom about volatility, security, and regulation.

Join Global Blockchain Solution as we explore the emerging world of asset tokenization - from how fractional NFT platforms aim to reshape art ownership to predictions that tokenized assets could exceed $5.6 billion by 2026. The tokenization train is leaving the station, promising to fundamentally reshape how we perceive value and ownership.

This Article Contains:

What is Tokenization?

Let’s understand asset tokenization with an easy example. In the past, physical cash was the sole means of exchange. When buying goods or services, people exchanged tangible banknotes and coins. Ownership was also physical - assets like real estate were represented by paper deeds and certificates.

With time, digital payments started replacing physical cash for many transactions. The transition wasn’t easy as people had to replace their notion of physical money with its digital counterpart. Governments across many parts of the world are still struggling to promote a cashless economy, as cash even today accounts for 85% of total consumer transactions globally.

But, we can all agree that the vision of cashless economies – or even “less-cash economies” – is also rapidly materializing. Rather than exchanging banknotes, your bank updates its central ledger digitally to facilitate payments. Money has evolved from a physical to a digital medium of exchange.

The same holds for securities. We no longer think of securities (such as stocks and bonds) the way they were thought of a hundred years ago when trading them actually meant exchanging share certificates and cash. Now, they are dematerialized and books are maintained electronically via your demat account.

Tokenization, similarly, aims to digitally represent ownership of all forms of tangible assets. Instead of paper deeds, real estate and art ownership are represented by digital tokens tracked on an immutable blockchain ledger. Since blockchains are immutable, the ownership is often more robust with strong provenance as compared to other electronically maintained ledgers.

Also Read: Blockchain Technology Explained: What is Blockchain?

Tokenization not only makes the ownership more provable but also improves the liquidity (and hence, the competitiveness) of any market. For example, a $10 million commercial property could be tokenized into 100,000 tokens, each valued at $100. These tokens represent fractional ownership of that property and can be easily traded 24/7, just like digital payments.

So, while digital money evolved to represent fiat currencies digitally, tokenization facilitates digitally representing ownership of real-world assets. This unlocks opportunities like accessibility, liquidity, and transparency in traditionally closed markets. On top of more reasonable ticket sizes, such practices also eliminate the tedious paperwork typically associated with such transactions.

Just imagine purchasing a property with all of its legalities fulfilled at the touch of a button.

How Does Tokenization Work on the Blockchain?

Blockchain provides the foundation for asset tokenization with its decentralized ledger system. Rather than a central party controlling transaction records, the ledger is distributed across a peer-to-peer network.

With Bitcoin, this architecture made digital money possible without centralized banks. Now, blockchains like Ethereum are enabling a new wave - digitizing real-world assets.

In 2020, CurioInvest tokenized a limited-edition Ferrari with a $1.1 million hard cap. A smart contract programmatically splits ownership into fractional 440,000 ERC-20 tokens. Suddenly, car enthusiasts worldwide could own slivers of the iconic F12 TDF for a few bucks.

Here's how it works:

The real-world asset is professionally appraised to determine fair market value.

Relevant blockchain is selected as per the unique requirements of the use case. A smart contract then divides ownership rights into digital tokens on the blockchain, each representing fractional ownership.

Tokens are issued containing programmed rules around various aspects of ownership and trading.

Owners can then trade tokens peer-to-peer on markets without intermediaries.

All transactions are permanently recorded on the immutable ledger, enabling transparent and provable ownership.

In summary, blockchain architecture provides a decentralized, transparent foundation for fractionalizing and trading real-world assets. The ability to make illiquid assets liquid and tradable globally is sparking a financial revolution.

Real-World Assets That Can Be Tokenized

A diverse range of real-world assets have been tokenized, enabling new models of fractional ownership and exchange. Here are some notable examples:

1. Real Estate

Tokenizing real estate assets is a leading use case. In 2020, Red Swan tokenized a $2.2 billion property in collaboration with Polymath. Recently, Chilean startup Wbuild tokenized a 37 m2 apartment in the ‘Vanguard Building’ project of Macul commune, with investments starting at $50. These developments reflect a new age of asset ownership.

2. Artwork

Fine art is being transformed by tokenization. In 2021, Andy Warhol's enigmatic digital painting "Self Portrait", which he created on the Amiga 1000 computer in 1985, was sold for $870,000 at Christie’s as an NFT.

3. Events

Staples Center – home to the NBA's Lakers and Clippers, the NHL's Kings, and the WNBA's Sparks – will rename itself to Crypto.com Arena in a $700 million deal. Many believe it’s a part of the larger invasion of blockchain into the world of sports and events. And, it makes sense. Everything from sports highlights to signed goodies and even extraordinary event tickets is a potentially collectible item for enthusiasts.

4. Equity and Bonds

Publicly traded stocks and bonds are also targets for tokenization. In 2019, Overstock issued digital preferred stock via its blockchain subsidiary tZERO. More recently in 2023, JP Morgan executed the first tokenized derivative trade on its all-new Tokenized Collateral Network (TCN), a JP Morgan application to use assets as collaterals without updating the underlying ledger.

5. Music Royalties

Artists are exploring tokenization to monetize their work and connect with fans directly. In 2021, musician Jacques Greene sold the publishing stake of his new song as an NFT, allowing buyers to earn a share of the song's future royalties. Such innovations are redefining the music industry's economics.

Also Read: Blockchain 101: How to create your own crypto app?

6. Luxury Goods

Tokenizing luxury goods like watches, handbags, and jewelry is gaining traction. In 2022, Nike launched its .Swoosh marketplace, a Web3-enabled platform to trade Nike’s digital collectibles – following Adidas’ Into The Metaverse series the previous year. Nike even sold an NFT sneaker for a whopping $134,000. Now, EA Sports has collaborated with the brand to integrate these NFTs into future EA Sports titles. The possibilities for such tokens are immense.

7. Rare Collectibles

Action figures, comic books, and other collectibles are no longer just for personal cabinets. They can be tokenized just like the 2015 Ferrari F12 TDF.

8. Natural Resources

Natural resources like gold, oil, and precious metals can also be tokenized. Pax Gold enables people to invest in the Pax Gold (PAXG) token, backed by an ounce of gold for every token. The benefits include increased liquidity, fractional ownership, and a more accessible way for average investors to access precious metal markets with zero custody fees.

Also Read: Impending Doom or Is Web3 the Future of the Internet?

Benefits of Tokenizing Real-World Assets

Converting ownership rights into digital tokens unlocks several key advantages:

1. Increased Liquidity

Through asset tokenization, traditionally illiquid assets, such as collectibles or vintage wines, can become more liquid.

2. Transparency

The immutable nature of blockchain brings unmatched transparency to tokenized assets. When an asset, like a historic manuscript, undergoes asset-backed tokenization, every transaction associated with it is indelibly recorded. The Maecenas platform, which specializes in tokenizing real-world assets, provides a clear history of art ownership, ensuring authenticity.

3. Accessibility

Tokenize assets and you democratize access to them. A luxury yacht, sports car, or apartment can be fractionalized through asset tokenization platforms like CurioInvest or RealT. Here, potential investors can own a piece of big-ticket investments for as little as a few dollars.

4. Efficiency

Tokenization of assets reduces intermediary involvement. This improves the efficiency of the market by removing unjustified charges. Similarly, since the average ticket size of investments reduces, fair market prices can be effectively reached.

5. Interoperability

Tokens representing real-world assets on one blockchain can often be integrated with other ecosystems.

Challenges and Concerns

But tokenizing real-world assets also involves several challenges:

1. Regulatory and Legal Hurdles

While asset tokenization is advancing, its regulatory framework is still in its infancy. If an archaeological artifact is tokenized, where does it stand in antiquities law? Countries like Switzerland, Japan, the U.K., and Switzerland have been proactive in creating legal frameworks for tokenizing assets, but a global consensus is still in progress.

Also Read: The Legality of Launching an ICO in the US in 2023

2. Technical Limitations

Though platforms like Ethereum have made strides in tokenization of assets, scalability remains an issue. As the demand for tokenizing real world assets increases, infrastructural robustness needs to keep pace.

3. Market Volatility

The value of a tokenized asset can be influenced by broader market dynamics. Consider a token representing a diamond's fraction on platforms like Mattereum. Its value might waver due to both the gem market and the volatile crypto space.

4. Security Threats

As with any digital platform, those that tokenize assets are at risk from cyber threats. Ensuring watertight security, as platforms like Securitize do, is crucial to protect both the assets and the investors.

5. Lack of Adoption and Understanding

Despite the potential, understanding and adopting the concept of owning parts of real-world assets through tokens can take time and effort. Outreach and education are essential to bridge this gap.

Conclusion: Navigating the Future of Asset Tokenization

The advent of blockchain technology has birthed a revolutionary way of looking at assets: through the lens of tokenization. As we've seen with examples spanning from Beeple's artwork to JP Morgan's Tokenized Collateral Network, the capability to convert the ownership of tangible and intangible items into digital tokens is not just a theoretical idea—it's here, and it's making waves.

Tokenization promises to revolutionize industries, making assets more liquid, transparent, and accessible. The dream of owning a sliver of a Picasso painting, a fragment of a beachfront property, or even a snippet of a beloved musician's masterpiece is no longer far-fetched. Instead, these are practical realities for today's investor, no matter the size of their pocketbook.

Yet, with every innovative step forward, challenges arise. Regulatory landscapes, technological limitations, and market volatility are among the hurdles the world of asset tokenization has to grapple with. The road to universal adoption is paved with concerns about security threats and the overarching need for understanding and education.

Nonetheless, the direction is clear. As the world gradually inches closer to a more digitized form of asset ownership, it's evident that the realms of traditional and digital finance are on a convergence path. The fusion of these spheres promises to create a world where assets of any kind, from the mundane to the luxurious, are within reach for all.

For stakeholders, from artists to investors, the key will be to stay informed, be adaptable, and recognize the transformative potential of this digital frontier. The future of asset tokenization beckons, and it's an invitation to reimagine the very essence of ownership and value.

If you want to tokenize your asset or want to build a solution that tokenizes assets for others, feel free to pick our brains on everything related to blockchain, NFTs, and asset tokenization. Contact us or schedule a free 15-minute consultation call with us.

Frequently Asked Questions

1. What is asset tokenization?

Asset tokenization represents real-world assets like real estate, art, or stocks with tokens on a blockchain. This allows for fractional ownership and improved liquidity.

2. How does asset tokenization work?

An asset is professionally appraised to determine its fair market value. A smart contract on a blockchain like Ethereum then divides ownership into digital tokens. These tokens can be traded peer-to-peer without intermediaries.

3. What are the benefits of asset tokenization?

Key benefits include increased liquidity, transparency through an immutable ledger, accessibility via fractional ownership, efficiency by removing intermediaries, and interoperability between token ecosystems.

4. What assets can be tokenized?

Many asset classes can be tokenized, including real estate, artwork, music royalties, luxury goods, financial instruments like stocks and bonds, and natural resources.

5. What are some challenges with asset tokenization?

Some key challenges include evolving regulations, blockchain scalability limitations, market volatility, security threats, and a lack of understanding among traditional investors.

Comments

Share Your Feedback

Your email address will not be published. Required fields are marked *